Statutory Benefits

Statutory benefits meaning

Statutory benefits refer to the mandatory benefits that employers are required by law to provide to their employees. These benefits are governed by specific legislation and vary by country or region. They typically include contributions such as social security, unemployment insurance, workers’ compensation, and health insurance in some cases.

The purpose of statutory benefits is to provide a minimum level of protection to workers, ensuring they receive essential benefits such as medical care, income support during periods of unemployment or disability, and retirement pensions. These benefits are financed through taxes or contributions that are usually shared between employers and employees.

Statutory benefits examples

As mentioned, statutory benefits are prescribed by law and can vary depending on the country or state. Here are some of the most common examples of legally required benefits in the U.S.:

U.S. statutory benefits examples

- Social Security: A foundational program that provides income for retired workers, for dependants, and for workers with disabilities and their families.

- Medicare: A federal health insurance program designed primarily for retired people but also available for certain younger people with disabilities.

- Unemployment insurance: Provides temporary financial assistance to qualifying individuals who become unemployed through no fault of their own and meet other state-mandated criteria.

- Worker’s compensation: Provides medical expenses, lost wages, and rehabilitation costs to employees who are injured or become ill at work.

- Family and Medical Leave Act (FMLA): Employees who are eligible can take unpaid, job-protected leave for specific family and medical reasons.

Examples of statutory benefits in other countries

In other countries, we can find a wider variety of statutory benefits:

- Paid leave (vacation, holidays, sick leave): In the Netherlands, an employee who works 40 hours a week (full-time employment) is entitled to at least 20 days (160 hours) of paid time off per year.

- Health insurance: In the United Kingdom, The National Health Service (NHS) provides healthcare funded through general taxation, making most health services free at the point of use for residents.

- 13th-month salary: In the Philippines, employers must pay a 13th-month salary equivalent to one-twelfth (1/12) of an employee’s total basic salary earned within a calendar year. This pay must be given to employees on or before December 24th of each year.

- Pension insurance: In Germany, contributions are split between the employer and the employee, providing benefits upon retirement, disability, or death.

- Maternity/paternity leave: In Spain, maternity leave is provided for 16 weeks, with 100% of the salary paid, funded through the social security system. Paternity leave is also offered, recently increased to match the duration of maternity leave to promote shared parental responsibilities.

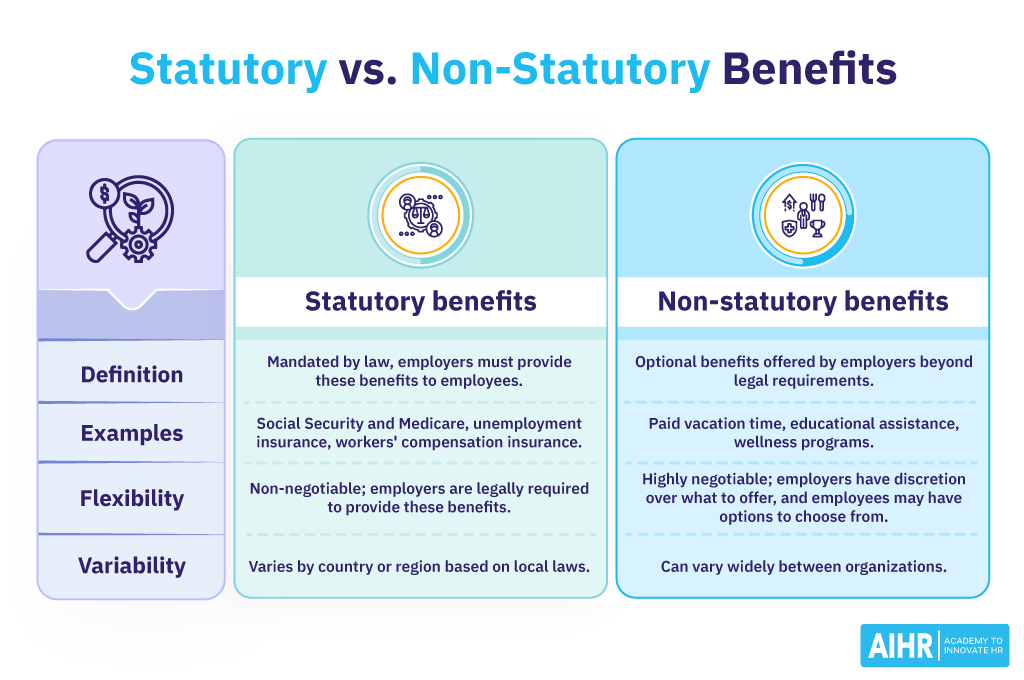

Statutory vs. non-statutory benefits: The differences

Statutory and non-statutory benefits (also known as discretionary benefits) are two types of employee benefits that organizations offer, but they differ in their nature and requirements.

Definition

Mandatory benefits employers are legally required to provide to employees.

Optional benefits offered by employers, not mandated by law.

Examples

– Social Security contributions

– Unemployment benefits

– Worker’s compensation

– Minimum wage

– Health insurance

– Retirement plans (beyond statutory requirements)

– Bonuses

– Stock options

– Wellness programs

Purpose

To ensure a minimum level of protection for workers in terms of income, safety, and health.

To attract, motivate, and retain employees by offering benefits beyond the basics.

Regulation

Governed by national or local government laws.

Determined by the employer, often influenced by market standards and competition.

Cost to the employer

Costs are generally fixed by law.

Costs can vary widely, depending on the range and generosity of the benefits offered.

Staying compliant with statutory benefits: 6 tips for HR

It is crucial for HR to stay compliant with statutory benefits and ensure their organization adheres to legal requirements and avoids potential penalties. Here are some comprehensive tips:

- Stay informed about any legal changes: Regularly monitor and stay up-to-date with legal changes related to federal, state, and local statutory benefits.

- Implement a compliance calendar: Create and maintain a compliance calendar that outlines key dates for benefit reviews, renewals, audits, and regulatory filings to ensure timely adherence to requirements.

- Use HR services providers or software solutions: Consider utilizing HR services providers or specialized software solutions that can help streamline benefit administration, track compliance, and generate reports to ensure regulatory adherence.

- Perform regular audits: Perform routine audits of benefit programs to assess compliance with regulations, identify gaps, and take corrective actions promptly.

- Conduct regular training and updates for HR staff: Regular training sessions for the HR team about changes in employment laws and statutory benefits are essential. This keeps the team informed and equipped to manage compliance effectively.

- Network with other HR professionals: Networking with peers in the industry can provide valuable insights and shared experiences related to managing statutory benefits. Professional groups and forums can be excellent resources for exchanging tips and solutions.

FAQ

Statutory benefits are benefits mandated by law and provided to employees by employers. These benefits can vary wildly depending on the country or region, as each jurisdiction sets its own laws regarding employee rights and benefits.

Statutory benefits vary significantly from country to country. However, 5 of the most commonly mandated benefits worldwide include:

• Social Security contributions: Funds for retirement, disability, and survivor benefits.

• Health insurance: Access to medical care, either directly or through national systems.

• Unemployment insurance: Financial aid for those who lose their jobs without fault.

• Workers’ compensation: Compensation for work-related injuries or illnesses.

• Paid leave: Includes holidays, sick leave, and parental leave, ensuring time off with pay.