Fringe Benefits

What are fringe benefits?

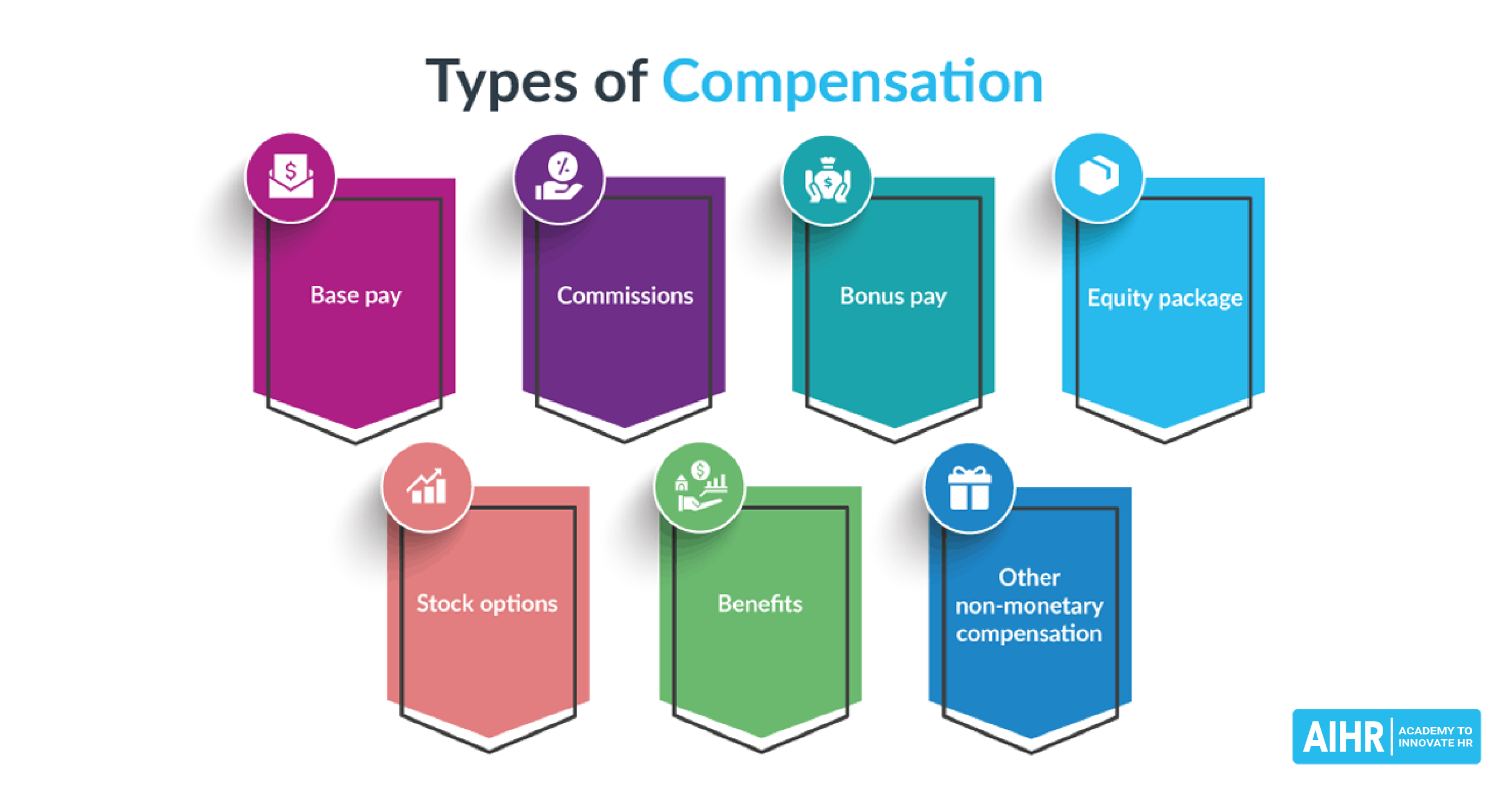

Fringe benefits refer to any form of long-term incentives or non-monetary compensation an employer offers employees. Such benefits exclude cash compensation like salaries and bonuses.

Fringe benefits can often apply universally to all employees; in other cases, they are specific to a group of staff, especially at the team and executive levels.

Some companies offer fringe benefits as compensation for employees’ costs incurred during their work. In other cases, such benefits are aimed at improving overall job satisfaction.

They can be offered on a voluntary or mandatory basis. Some benefits, such as health insurance and retirement plans, are often mandatory under federal and state laws. Others, such as gym memberships and employee discounts, are voluntary benefits that an employer can offer to enhance the overall compensation package.

Fringe benefits are an essential part of a compensation package, providing additional incentives for employees to stay with the organization.

Are fringe benefits taxable?

Fringe benefits can either be taxable or non-taxable. Most employees and employers consider fringe benefits free and not entitled to taxes. That is not always the case.

Employee benefits can attract significant taxes on the part of the employees. However, there are certain exceptions.

Let’s explore the difference between taxable and non-taxable income.

1. Taxable fringe benefits

Taxable fringe benefits are incentives that do not offer any form of tax relief to an employee or the employer. Usually, where no exception is made, the benefits will be taxed.

Common examples of taxable fringe benefits include the following:

- Vacation expenses

- Group-term life insurance

- Relocation expenses

- Gym memberships

- Personal use of a company car.

2. Non-taxable fringe benefits

Technically, any fringe benefits an employer offers their staff are subjected to either employment taxes or tax withholding. However, such benefits are considered non-taxable fringe benefits when a tax exception is made.

Examples of non-taxable fringe benefits include:

- Employee stock options

- Employee discounts

- Job-related education help reimbursements

- Tips.

How to calculate fringe benefits

Usually, fringe benefits are calculated by comparing an employee’s annual salary and the expected cost of the benefit. Thus, the fringe benefit rate is reached by expressing an employee’s full fringe benefit as a percentage of their salary.

Usually, the fringe benefits rate used for salaried individuals differs for the casual workers. The varying elements factored when calculating the rate bring the difference.

Advantages of fringe benefits

Notably, offering fringe benefits is highly advantageous in any company. Some common advantages of fringe benefits include the following:

- Source of employee motivation: Companies use fringe benefits as a form of employee motivation. Usually, when motivated, employees are highly likely to take less time on their tasks, saving the organization a lot in costs.

- Reduced turnover: High turnover rates harm any organization. For instance, it is highly costly to replace employees who leave. With better perks, employees are unlikely to leave their job. In the end, the company saves a lot in terms of recruitment, selection, and training costs.

- Increases employee knowledge: When the fringe benefits are in the form of education support, employees gain significant knowledge that can help grow the company.

- Improved health and wellness: Fringe benefits such as additional health insurance and wellness programs can help employees stay healthy and reduce healthcare costs. This can also help employees feel more engaged and productive at work.

Disadvantages of offering fringe benefits

Some notable disadvantages of offering fringe benefits in an organization include the following:

- If your employees are only attracted to your company because of the size of the compensation package and the benefits offered, then the organization runs the risk of losing talent to competitors who offer a more attractive compensation package. Consider whether your organization provides employees with more than just great fringe benefits.

- Maintaining the culture of offering fringe benefits can be costly in the long run. Usually, employers need to ensure fringe benefits, increasing administrative costs significantly.

- Fringe benefits are hard to customize in favor of an employer because most are standardized.

Fringe benefits in compensation: What HR should consider

Fringe benefits are often used as a form of motivation for employees. When done correctly, offering fringe benefits could enhance an organization’s productivity and employee job satisfaction.

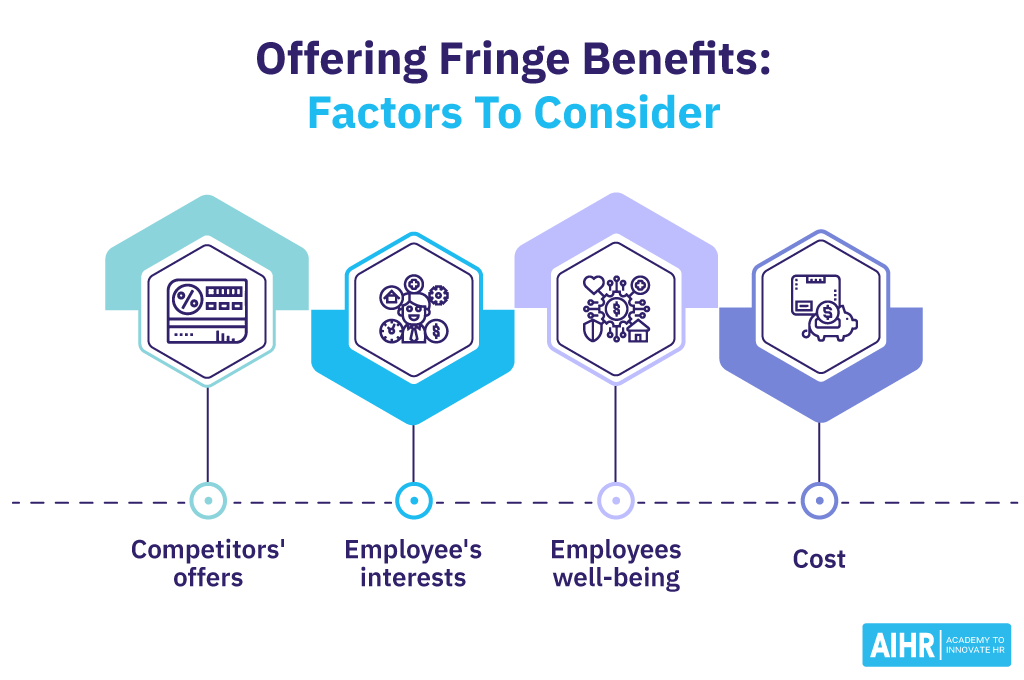

Here are some critical factors an HR should consider when including fringe benefits in the compensation package:

- Competitors’ offers: When thinking of the most suitable fringe benefits, HR should compare what competitors are offering. This can inform what benefits the company should consider offering within the capabilities of the business.

- Employee’s interests: Often, fringe benefits are about motivating employees to be productive and stay. As such, it is advisable to consider their interests when thinking of the fringe benefits to offer.

- Employee well-being: The well-being of the employees is an important element that should inform an HR’s decision on the fringe benefits to offer. It is recommended to opt for benefits that are geared towards enhancing the employees’ well-being.

- Cost: Analyzing the cost the organization will incur in the fringe benefits program. Such costs should not be unnecessarily huge, as increased administrative expenses would negatively impact the organization’s profit margins in the long run.

- Review benefits regularly: HR should review the organization’s fringe benefits regularly to ensure they are still relevant and valuable to employees. This can include conducting employee surveys and analyzing the costs and ROI of each benefit.