Commission Pay

What is commission pay?

Commission pay is a variable form of compensation where an employee gets paid based on the amount of work they achieve or a percentage of sales they make. Commission pay is most often used for sales positions as incentive to increase sales volume and transaction amounts.

In most cases, an employee will need to be paid a gross wage or salary in addition to their commission pay. In a few very specific exceptions, an employee’s pay may consist entirely of commission payments based on their performance or the value of their total sales each pay period.

Commission vs. salary

| Commission pay | Salary | |

| Predictability | Variable and unpredictable pay amounts based on sales performance. | Pay is predictable, and employers can forecast payroll expenses accurately. |

| Performance incentives | Strong financial motivation for employees to maximize performance or sales. | Since the pay is not directly tied to performance, it may lead to less motivation to exceed job expectations. |

| Risk management | Higher risk due to potential large commission payouts, especially during periods of strong sales. | Low risk as employees receive a consistent income, providing financial consistency regardless of fluctuations in business performance. |

| Targets and productivity | Sales targets and quotas can drive revenue, but may encourage short-term focus. | Salaried employees may focus on long term goals and quality of work without the pressure of immediate sale targets. |

How does commission pay work?

Under a commission pay system, an employee’s earnings are directly tied to their performance. Companies set commission rates, which are usually a percentage of each sale or the total amount of sales over a defined period, and they can vary widely depending on the industry and the specific terms of employment.

To calculate commission payouts, companies first define the commission rate and the timeframe it applies to, such as 1% of each transaction or 5% of total monthly sales. Sales results are tracked over that period and then multiplied by the predefined commission percentage rate to derive the payout amount owed. For example, if a salesperson made $30,000 in total sales last month and has a 5% commission rate, their commission pay for the period would be $30,000 x 0,05% = $1,500.

Regardless of the commission structure, employers must ensure that their pay practices comply with minimum wage and labor laws. This means that if their commission does not equal minimum wage, the employer may need to make up the difference.

Advantages and disadvantages of commission-based pay

Advantages

- Motivation for higher performance: Employees on commission are motivated to work harder, sell more, and improve their performance, as their income is directly tied to their results.

- Flexibility in pay structure: Employers can adjust commission rates and structures based on business needs, market conditions, or employee performance, allowing for more dynamic management of labor costs.

- Attracting and retaining talent: A commission-based structure can attract high-performing, ambitious employees who are confident in their sales skills and motivated by the prospect of potentially higher earnings.

- Reduced fixed costs: For employers, commission pay helps manage fixed costs effectively, as compensation varies with sales performance. This aspect is particularly beneficial for businesses experiencing fluctuating sales volumes.

Disadvantages

- Potential impact on mental health: The pressure to meet sales targets to earn a decent income can lead to stress and burnout, affecting employee wellbeing and productivity.

- Lower quality of work: Employees might prioritize quantity over quality, focusing on making more sales rather than the best sales or providing excellent customer service.

- Income inconsistency for employees: The variability in earnings can be a demotivating factor for some employees, especially during low sales periods. This inconsistency can contribute to higher turnover rates.

- Conflict between employees: Commission structures can foster unhealthy competition among employees, leading to conflicts and a negative work environment.

Commission pay examples

There are several types of commission pay structures that employers can offer. Each one creates a different form of incentivisation based on the role and performance goals you wish employees to achieve.

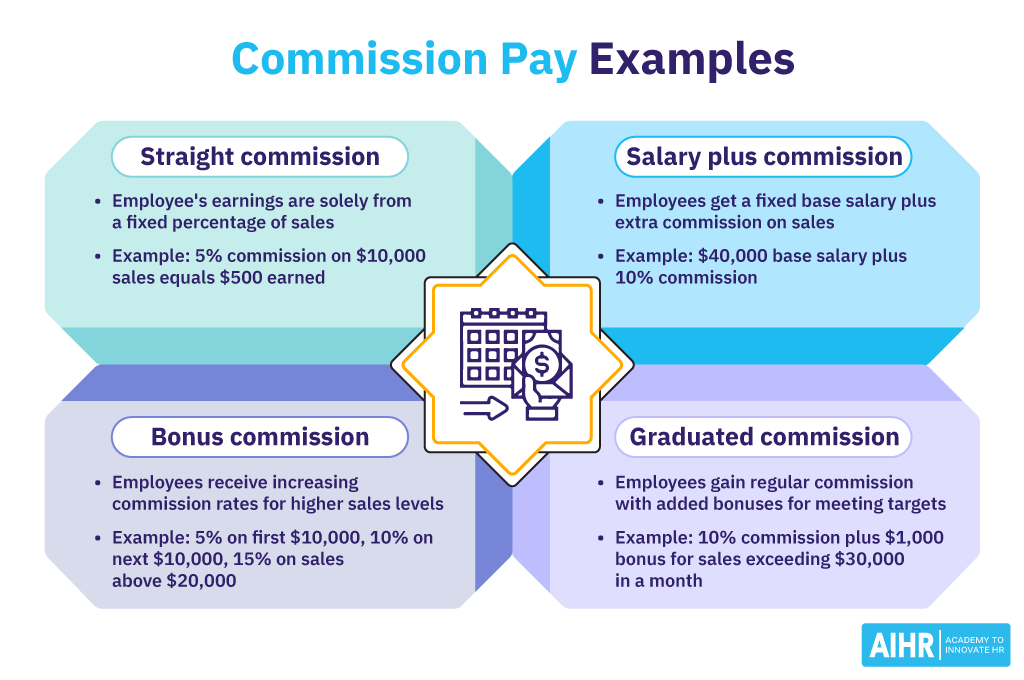

1. Straight commission

Employees do not receive a base pay and only earn a fixed percentage of the value of the sales they generate. For example, if an employee sells $10,000 worth of products and the commission rate is 5%, they would earn $500.

2. Salary plus commission

Employees receive a base salary, plus an additional commission based on the sales they make. For instance, an employee might have a base salary of $40,000 per year, plus a 10% commission on sales.

3. Graduated commission

Employees earn an increasing percentage of commissions for reaching higher levels of sales or performance numbers. For example, an employee might earn a 5% commission on sales up to $10,000, 10% on sales between $10,001 and $20,000, and 15% on sales above $20,000.

4. Bonus commission

Employees are paid regular commission payments, but with an additional bonus for reaching certain targets or milestones. For instance, an employee might earn a standard 10% commission on all sales, but if they exceed the target of $30,000 in a month, they might receive an additional bonus commission of $1,000.

Examples of jobs that pay commission

- Real estate agents

- Car salespeople

- Retail sales associates

- Insurance salesperson

- Travel agent.

Commission pay calculator

How do you calculate commission pay? If calculated based on sales, the typical formula is:

- Commission pay = sale amount x commission rate

Let’s say your commission rate is 20%, and an employee closes a $15,000 sale. Their pay for this sale would be:

- $15,000 x 0.20 = $3,000

- The employee would be paid $3,000 for this sale.

In another example, a retail employee closes 20 sales in a day, equaling $5,000, with a commission rate of 15%:

- $5,000 x 0.15 = $750

- The employee has earned $750 for the day.

Of course, commission can also be paid at a flat rate. Let’s say a technician employee is given a $50 commission for every system they install. The employee is paid a base salary of $3,000 a month, plus what they can earn in commission. This technician installs 40 systems in a month’s time.

- $50 x 40 = $2,500 commission pay

- $3,000 + $2,500 = $5,500 monthly pay

- The employee has made $5,500 for the month.

HR tip

Commission pay policies must be created with absolute understanding of legal pay requirements for each role. Make sure you don’t violate the legal minimum wage requirements or misclassify employees as exempt sales workers. For example, remote workers are not considered traveling sales professionals, though they are outside the workplace. Build your commission pay guidelines very carefully based on labor laws and the precise roles of each commissioned employee.