Pay Mix

What is pay mix?

Pay mix refers to the ratio of fixed pay to variable pay in an employee’s compensation. A pay mix ratio is typically used in sales departments to motivate employees to reach or exceed their targets.

The usual ratios are 60:40, 70:30, and 75:25. A 60:40 pay mix means 60% of the salary is fixed pay, and 40% is variable pay. The greater variance in the ratio, the greater the variable pay. So, for example, 60:40 means more of an employee’s pay is at risk compared to 80:20.

It’s important to choose the appropriate mix for your workplace to ensure employees are motivated.

What are the components of a pay mix?

A pay mix has two main components.

- Fixed pay or base pay: The amount paid to an employee in exchange for their work before tax and other deductions.

- Variable pay: Compensation awarded to employees based on their performance. In the case of pay mix, this is usually sales-based commission, but it may also be in the form of bonuses or profit-sharing.

Pay mix factors

There are several factors that need to be considered when determining the pay mix:

- Leverage: What is the benefit of using a pay mix? Does it lead to a greater number of sales?

- Performance: Goals need to be set appropriately so that employees can achieve them. If, for example, only 25% of the company achieves their goals, it will lead to employee dissatisfaction, as only a small portion of employees would be paid their sales commission.

- Weighting: Balancing the difference between employees’ base pay and variable pay.

- Timing: Consider the timing of the payout of variable pay/commission so that it aligns with your pay cycles.

- Influence of role: A sales manager differs from a sales rep. Roles have different levels of responsibility and influence, which means that the ratio has to be adjusted accordingly.

- Sales cycle: A longer sales cycle generally means that more work and extra motivation will be required. Therefore, a higher pay mix is needed. On the other hand, a shorter sales cycle means a lower pay mix is needed because sales are closed more frequently.

- Product/service complexity: The more complex your offer is, the higher the possibility is that you’ll wish to employ a sales rep who is an expert regarding your industry, brand, or solution. Therefore, you’ll need a higher pay mix for motivating compensation.

- Company philosophy: Based on your product or service, you need to determine if an aggressive or conservative approach is needed.

How is pay mix calculated?

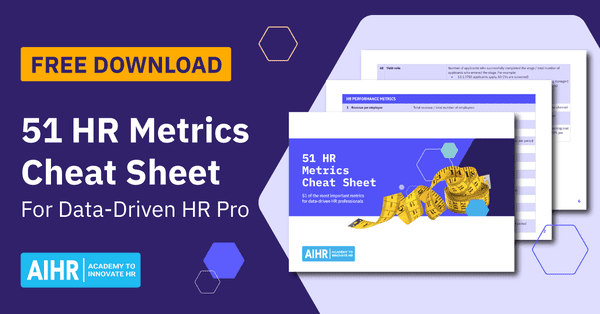

To calculate pay mix, you need to understand target total compensation (TTC). This is the expected total pay an employee receives after achieving their baseline goals, which is added to their base pay. TTC is used to motivate sales employees to achieve their sales quota.

In other words, TTC refers to the earnings a sales rep can earn if they achieve 100% of their sales quota.

The TTC formula is:

Base pay + commission/bonus. This can also be used to understand the pay mix ratio.

A ratio of 0/100 means that the job is purely commission-based.

If the pay mix is 60/40, and the employee achieves 100% of their goals, then it means they are paid the full amount. Let’s say the amount is $100,000; this would mean that the base pay is $60,000, and the variable or commission pay is $40,000.

What’s the average pay mix?

There’s no hard rule when it comes to the average pay mix. This is determined by the company, industry, and country. A study by The Alexander Group found the following averages for sales compensation pay mix in different countries:

| Country | Average Pay Mix |

| United States | 44/56 |

| Mexico | 51/49 |

| Brazil | 53/47 |

| France | 53/47 |

| Germany | 53/47 |

| United Kingdom | 53/47 |

| Russia | 50/50 |

| Japan | 60/40 |

| China | 63/37 |

The pay mix ratio can also be influenced by individuals’ tolerance levels and various socio-economic factors that determine whether a conservative or aggressive ratio is more suitable.

Another factor to consider is the average pay ratio according to the job level:

| Country Risk Tolerance Groups | |||

| Job Persuasion Groups | A United States |

B Mexico, Brazil, France, Germany, United Kingdom, Russia |

C China, Japan |

| Group 1: Named account manager |

45/55 | 50/50 | 60/40 |

| Group 2: Overlay specialist Global account manager |

60/40 | 65/35 | 70/30 |

| Group 3: Channel manager Business development roles |

70/30 | 75/25 | 80/20 |

An important factor to keep in mind is a role’s influence over sales. Some roles are directly involved in sales, giving them a greater chance to meet commission targets. Others play managerial or influential roles and, therefore, may not always be in a position to close the deal themselves.

The importance of choosing the right pay mix ratio

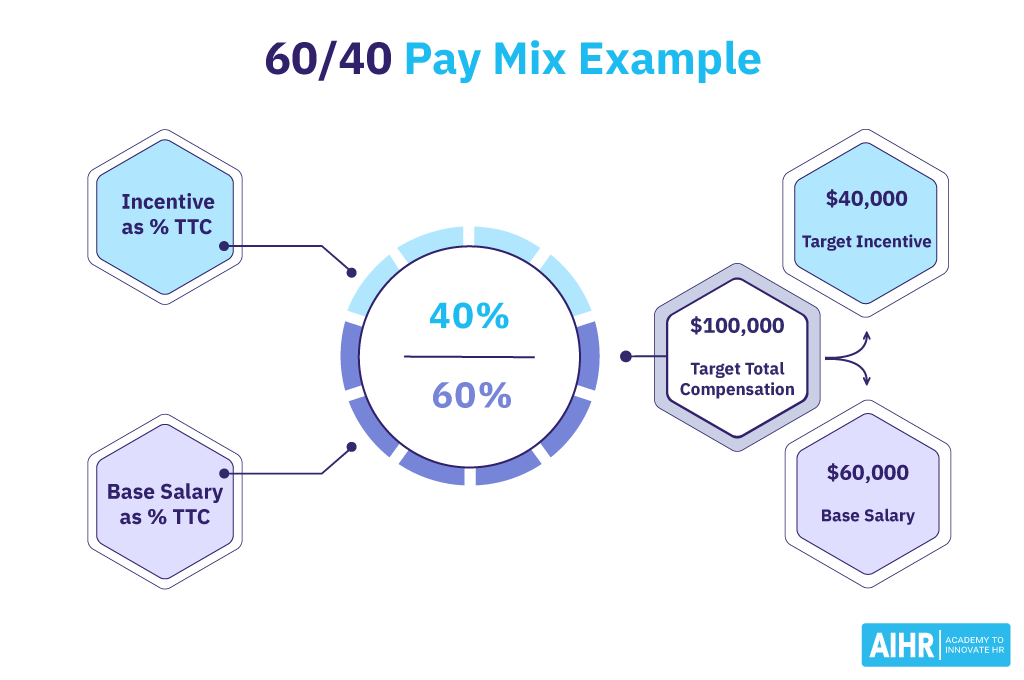

An employer needs to choose the right balance of fixed to variable pay, as it can have a big impact on recruitment. Take a look at the graph below:

Firm 1’s original offer pays $100k at the most, whether goals are exceeded or just met. Offering an employee, for example, $105k pay, which means a base salary, and variable compensation, which offers 5% more than the original offer, means that employees can earn more by earning the company more money.

Most employees generally prefer a significant base salary with variable pay that gives them the potential to make more, such as in Alternative 2a or Alternative 2d.