Gross Wages

What are gross wages?

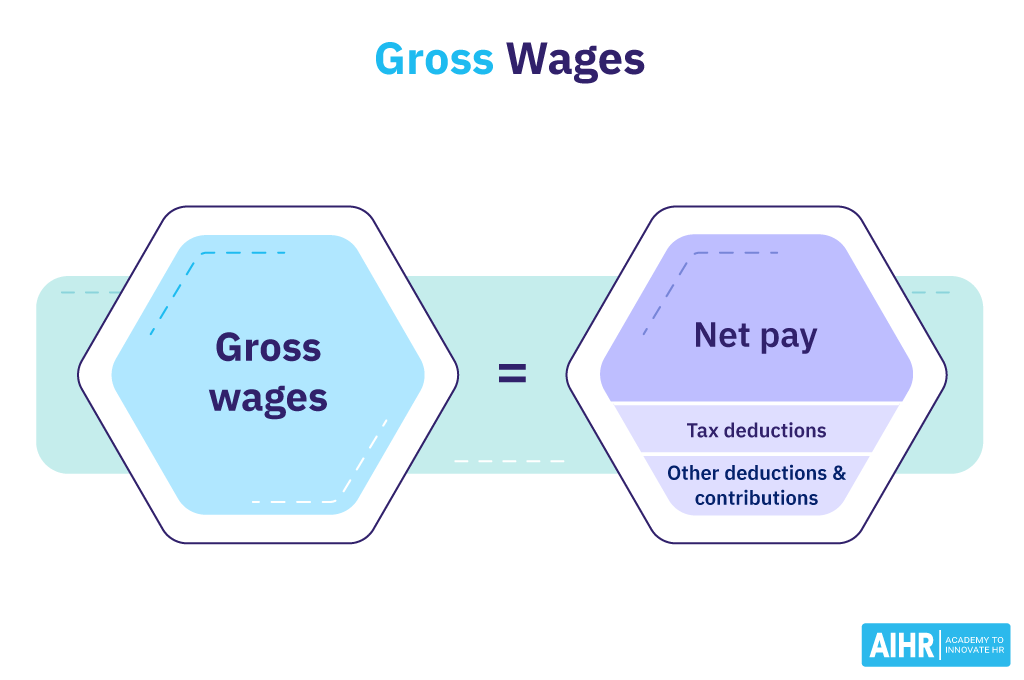

Gross wages and salaries are the amounts earned by an employee before taxes and deductions are taken from the paycheck. In other words, this term refers to the taxable compensation an employee receives.

What is included in gross wages?

The salary or wage itself is not the only thing included in gross wages. The following can also be included in the gross wage:

- Overtime

- Tips

- Commissions

- Bonus payments

- Reimbursements

What is the difference between gross wages and net wages?

Gross pay is the employee earnings before any deductions, whereas net pay is the amount of pay received after deductions. Net pay, in other words, is the amount of money an employee ‘takes home.’

For example, an employee’s monthly gross wage might be $5,000.

Net pay could look something like this:

Gross Wage ($5,000) – Tax (400) – Retirement contribution (300) – Other deductions (300) = $4,000

How to calculate gross wages

There’s a difference between employees that receive a salary and employees that receive an hourly wage.

Employees that receive a salary

To calculate the gross wage per month for a salaried employee, simply divide their annual salary by 12. So, for example, if an employee earns an annual salary of $75,000, their monthly gross wage equals $6,250.

For employees that paid hourly

If an employee, for example, earns $30 an hour and works 45 hours a week for three weeks per month:

($30 x 45 hours) x 3 weeks = $4,050

Examples of deductions

Deductions are amounts taken from the gross wages, which will result in employees’ net pay. Some required deductions include:

- Social security deductions

- Local, federal, and payroll taxes

Other deductions from the gross pay (that may or may not be required) include:

- Retirement savings

- Medical benefits

- Work-related tools or equipment

- Other benefits offered by the employer.