Salaried Employee

What is a salaried employee?

A salaried employee is an individual who is hired to handle a particular job and is paid a fixed amount of money, regardless of the hours they work per week.

The standard working hours are 40 hours per week, which means a salaried employee receives the agreed-upon salary even if they work for fewer hours. Moreover, employers don’t offer overtime pay for salaried employees who work for more than standard hours.

A salaried employee typically receives a paycheck bi-weekly or monthly. In addition, their payroll may include paid holidays, healthcare programs, and other benefits.

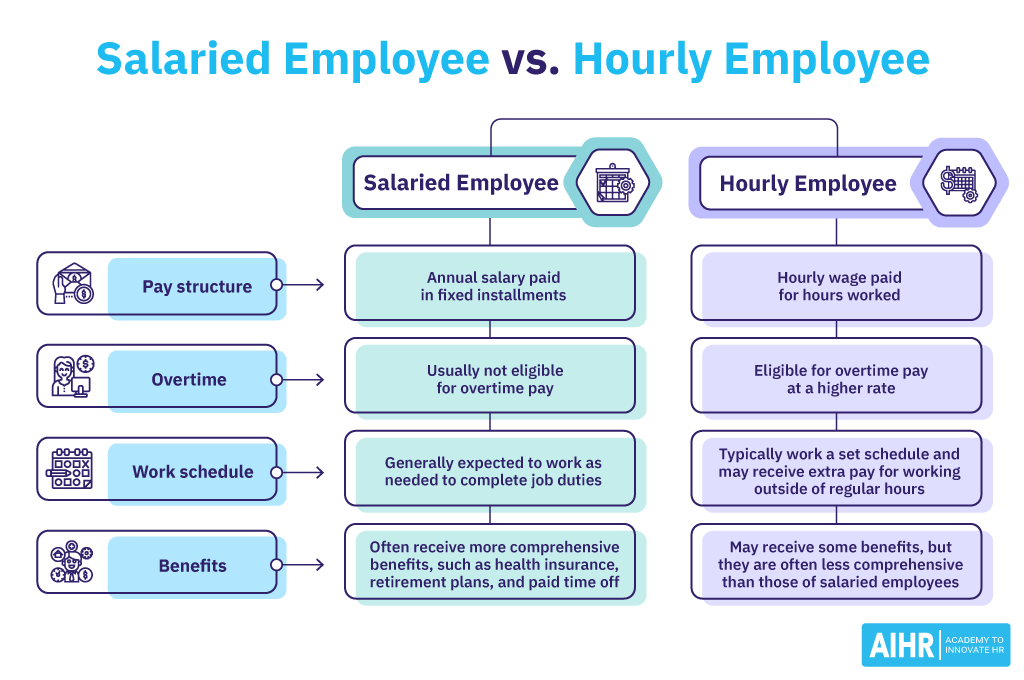

Salaried employee vs. hourly employee

| Aspect | Salaried Employee | Hourly Employee |

| Pay Structure | Annual salary paid in fixed installments | Hourly wage paid for hours worked |

| Overtime | Usually not eligible for overtime pay | Eligible for overtime pay at a higher rate |

| Work Schedule | Generally expected to work as needed to complete job duties | Typically work a set schedule and may receive extra pay for working outside of regular hours |

| Benefits | Often receive more comprehensive benefits, such as health insurance, retirement plans, and paid time off | May receive some benefits, but they are often less comprehensive than those of salaried employees |

Exempt employee vs. nonexempt employee

Employees can either be classified as exempt or nonexempt employees based on their FLSA status. Employees are exempt from protections of the Fair Labour Standards Act (FLSA) if they satisfy the eligibility requirements in the exemption categories listed in the law. Their salary meets or supersedes the salary threshold.

Conversely, employees who don’t meet the requirements are considered nonexempt from the FLSA. The minimum wage covered nonexempt workers are entitled to is $7.25/hour.

Like their exempt counterparts, nonexempt workers are paid on a salary basis. The only difference is that exempt employees must meet specific salary and duties requirements to be FLSA-exempt as management-level employees.

They are not subjected to salary deductions due to variations in the quality or quantity of work performed. An unauthorized reduction in a salary impacts the salary basis requirements, meaning the affected employee failed to meet the criteria to be exempted from the FLSA protection.

It is important to note that these differences can vary depending on the specific employer and industry.

How does salary pay work?

In the United States, the standard working hours per week is 40 hours. In various states, however, working more than normal hours is regarded as overtime. For instance, in California, any given minute after the eighth hour in any given day is subject to overtime, but in New York, overtime begins after the 40th hour worked in any given week.

That means that employees in New York may work 10-hour days and not receive overtime pay, while in California, the employee who has worked overtime gets paid for the regular eight hours plus two hours for each of the four days. Overall, overtime is calculated as “time and a half” (1.5 times the normal wage, plus 50%).

In Europe, however, the regular working hours depend on the country. For example, in France, the regular working hours per week is 35 hours, with restrictions on overtime, but in Switzerland, workweek hours depend on the business sector. Industrial, service, and retail employees work 45 hours a week and 50 hours in other industrial sectors.

HR tip

Looking at your unique business needs is crucial when discussing hourly vs. salaried employees. For example, if you regularly need to increase and decrease your workforce, it would be best to pay hourly. But if you want to retain a stable workforce with high skills and low employee turnover, employing workers on a salary basis is the right move.

Part-time salaried employee

A part-time employee is a person who works less than the regular working hours during a work week. In the US, part-time employees work below 30-35 hours per week, although every company stipulates its own number of hours for part-time employees. So, to clarify whether a part-time employee can be salaried, the answer is “yes.”

Technological advancements have enabled employees to handle some of their work at home. Besides that, many employers allow their employees to work on a part-time salaried basis, providing flexibility for both parties.

HR leaders and managers must consider several practical issues when managing employees transitioning to part-time work. Some of these factors include:

- Agreements on the new working plans and patterns

- Monitoring the hours worked

- Managing expectations and workloads

- Work-life balance and employee well-being

- Communication.

How HR can determine salaried employees

Determining whether an employee should be salaried is crucial (but challenging) work for HR. Not only are money matters sensitive, but several factors come into play when determining a fair and competitive remuneration rate for an employee. Some of these factors include:

- Years of experience and education level and achievements

- Industry

- Location

- In-demand skill sets

- Supply and demand.

Additionally, there are further considerations for HR:

1. Salaried employee or hourly employee?

Usually, the biggest challenge for employers is determining whether an employee should be salaried or paid hourly. Well, that depends: Is the worker exempt or nonexempt?

If they are classified as a nonexempt employee under FLSA, the employer must pay them hourly, which takes care of the decision for HR. However, the employer may consider making a salaried employee hourly if the employee’s weekly working hours aren’t consistent.

2. What are the state regulations and industry standards?

When considering your balance of salaried and hourly employees, it is crucial to keep state regulations and industry standards in mind. In the US, the FLSA determines whether or not an employee can be salaried or hourly.

However, a combination of state laws and company laws regulate how employers approach the matter. For example, most states favor paying hourly employees over a certain period, while others prefer other compensations, such as benefits and PTO for salaried employees. Therefore, it’s crucial to consider state laws when determining an employee’s status.