Imputed Income

What is imputed income?

Imputed income refers to the value of non-cash benefits or extra perks employees regularly receive that are not considered a part of their basic salaries. These benefits have a monetary value and, so, can be regarded as part of the individual’s income for tax purposes, even though the individual does not receive this compensation in the form of cash.

Paying for the benefits is not necessarily an employee’s mandate. However, they are responsible for the tax deductions applicable.

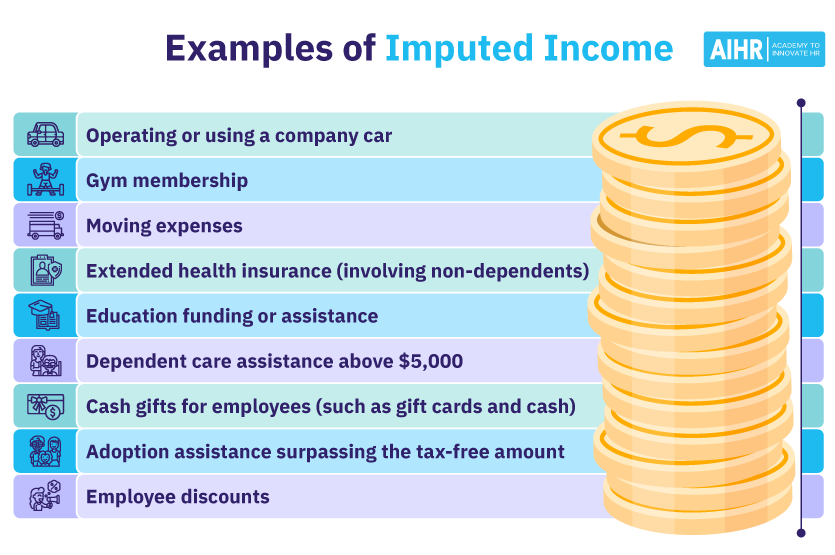

Examples of imputed income

Taxation on fringe benefits depends on their value in monetary terms and the applicable federal rates. Although not included in the basic salary, imputed income is treated as an earning; this means that taxes are deducted based on the total value received.

For example:

- Operating or using a company car

- Gym membership

- Moving expenses

- Extended health insurance (involving non-dependents)

- Education funding or assistance if over $5,250 per year

- Dependent care assistance above $5,000 per year

- Cash gifts for employees (such as gift cards and cash)

- Adoption assistance surpassing the tax-free amount

- Employee discounts.

What is excluded from imputed income?

Tax exemptions on some benefits may apply depending on specific corporate provisions and policies. Companies usually determine tax deductions based on the value threshold and if the benefit falls under special treatments.

Examples of tax-exempt benefits include:

- Dependents’ health insurance

- Education assistance under $5,250

- Adoption assistance under the annually adjusted amount

- Health savings account

- Group term life insurance under $50,000

- Small company gifts, such as birthday cakes and branded company shirts, among others

- Dependent care assistance under $5,000.

How to calculate imputed income

Companies calculate and determine imputed income depending on the type of employee benefits and services. Here are 5 general steps to calculate it:

- Identify the benefit: Determine which non-monetary benefits the employer provides are considered imputed income under tax laws.

- Determine Fair Market Value (FMV): Estimate the benefit’s fair market value. This is the amount an individual would pay for the benefit if they were to buy it in an open market.

- Subtract any contributions by the employee: If the employee pays a part of the cost for the benefit, subtract this amount from the FMV.

- Apply any exclusions: Some benefits may maintain exclusions or thresholds under tax laws. Apply these rules to reduce the taxable amount of the benefit.

- Calculate the imputed income: The result is the imputed income that will be added to the employee’s gross taxable income.

Examples of imputed income calculations

Here are a few examples of how imputed income might be calculated for different benefits:

Example 1: Company-provided housing

In this case, the company begins by determining the house’s Fair Market Value through a comparison with similar establishments in the neighborhood. Upon determining the FMV, the company deducts the amount payable as rent. The resultant amount is, in this case, the imputed income.

- FMV: $18,000 per year ($1,500 per month)

- Employee contribution (rent): $6,000 per year ($500 per month)

- Imputed income calculation: $18,000 – $60,000 = $6,000 = $12,000

The imputed income from the company-provided housing, which will be added to the employee’s gross taxable income for the year, is $12,000.

Example 2: Company-provided car

To calculate the FMV of personal use, companies often use one of several IRS-approved methods. For this example, we’ll use the Annual Lease Value method, which is based on the value of the car.

- Car’s original value: $25,000

- Annual Lease Value (ALV) according to the IRS table: $6,000 (This is a simplified figure; the actual ALV would be determined by an IRS table based on the car’s value.)

After determining this value, the company multiplies the amount by the car’s percentage usage within a specific period. In most cases, corporates use trackers to determine car usage in terms of distance and mileage. Multiplying the car’s FMV and the percentage of usage results in imputed income.

- FMV: $6,000

- Personal use (percentage): 9%

- Imputed income calculation: $6,000 * 9% = $540

The imputed income from the company-provided housing, which will be added to the employee’s gross taxable income for the year, is $540.

How can HR report imputed income?

Here’s a general guideline on how HR can report imputed income:

- Identify imputed income: Determine which benefits or non-cash compensation provided to employees qualify as imputed income according to IRS guidelines.

- Calculate the value: Use IRS rules and tables to calculate the monetary value of each type of imputed income. This calculation often involves standardized valuation formulas provided by the IRS, such as the Annual Lease Value for personal use of a company vehicle.

- Report on W-2 forms: Add the total calculated value of imputed income to employees’ W-2 forms. The wages, tips, and other compensation boxes should include this amount.

- Communicate with employees: Clearly communicate with employees about what imputed income is, how it affects their taxable income, and where it appears on their W-2 form. This helps in managing expectations and answering any questions regarding changes in their reported income.

- Keep detailed records: Keep detailed records of how imputed income values are calculated and reported for each employee. This is crucial for internal records, compliance with tax laws, and preparation for any potential audits.

HR tip

Use the IRS Form W-2 for reporting imputed income, as required by law, and actively inform employees about the significance of accurately withholding federal tax from imputed income to prevent legal and financial issues.

FAQ

The taxation of imputed income involves adding the fair market value of non-cash benefits to the employee’s taxable income, making it subject to federal and possibly Social Security and Medicare taxes. The employer is responsible for calculating the value of these benefits and reporting them to both the employee and the IRS, typically using form W-2 or other relevant tax documents.

Imputed income is not directly taken out of every paycheck but is added to the employee’s taxable income for the year. Employers report it on the W-2 form, affecting taxes based on total annual income. The impact on take-home pay varies depending on the employer’s payroll practices and the nature of the imputed income.