1099 Employee

What is a 1099 employee?

A 1099 employee, also known as an independent contractor, is a worker who provides a service to a company but is not an official employee. The term ‘1099 employee’ comes from the IRS Form 1099 that contractors receive at the end of the year to report their earnings. Unlike regular employees who are issued a W2 and have taxes withheld from their paychecks, 1099 workers are responsible for managing and paying their own taxes, including self-employment tax.

Due to their self-employed status, they typically don’t receive benefits such as health insurance, retirement plans, or paid leave from the hiring entity. However, they often enjoy more flexibility and autonomy in how they conduct their work.

What qualifies as a 1099 Employee?

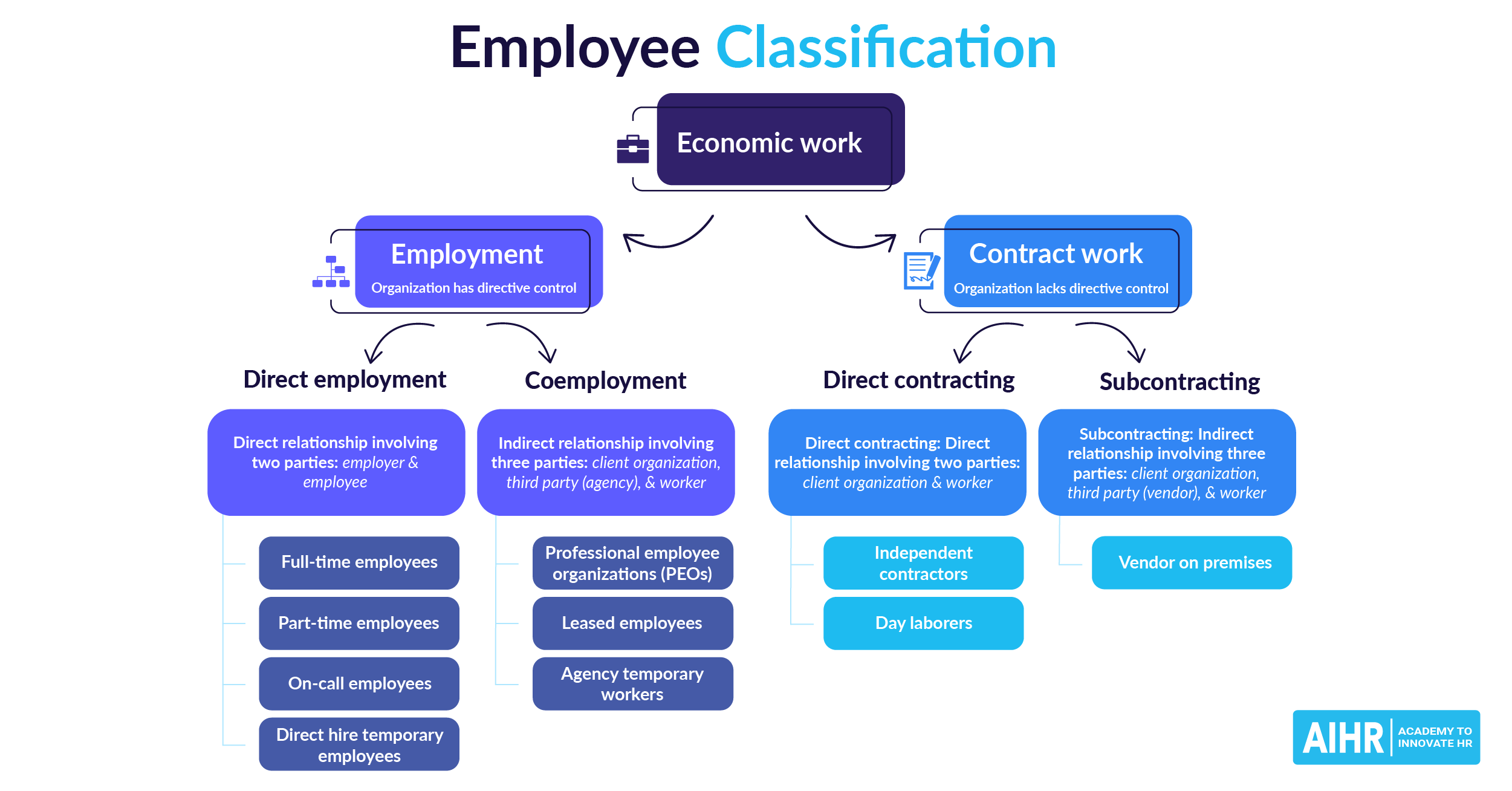

The Internal Revenue Service (IRS) focuses on three main categories to ensure employees and independent contractors (1099 employees) are classified properly:

- Behavioral control: Refers to whether the organization has control or the right to control what the employee does and how they do their work.

- Financial control: Refers to whether or not the business aspects of the employee’s work are controlled by the payer.

- Type of relationship: Refers to facts that show how the worker and business perceive their relationship with each other.

1099 employee vs. W2 employee

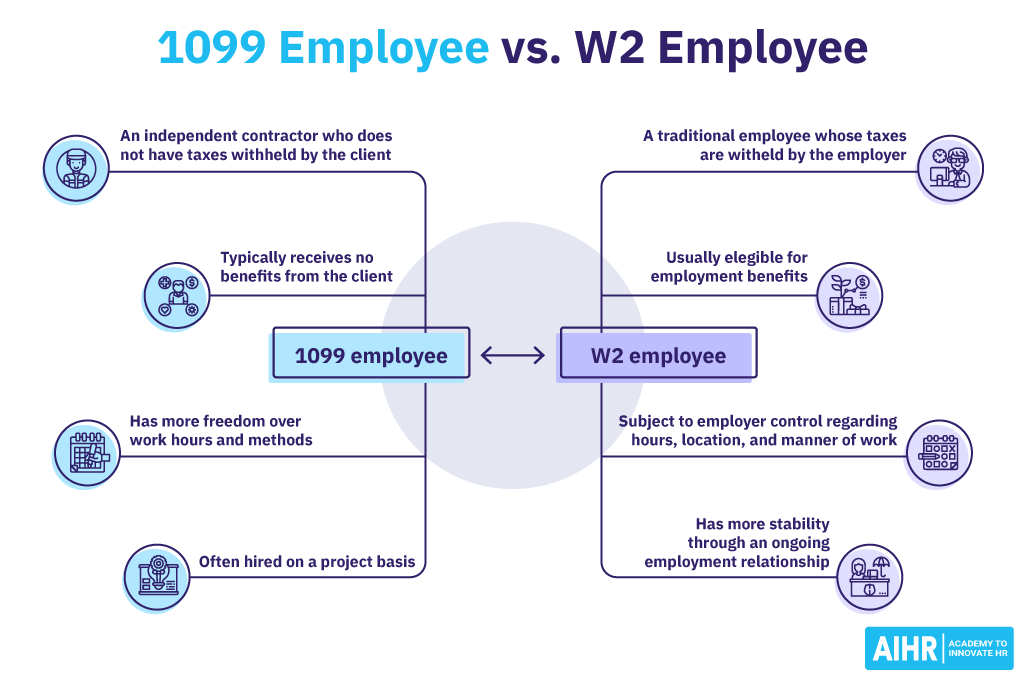

For the employer, the distinction between a 1099 employee and a W2 employee revolves significantly around financial responsibility.

A W2 employee is considered a traditional employee whose taxes are withheld from their paycheck by their employer. They also receive employment benefits like health insurance, have protections such as minimum wage and overtime pay, and are subject to a considerable amount of employer control regarding how, when, and where their work is done.

In contrast, a 1099 employee (or independent contractor) typically does not have taxes withheld by the client, is responsible for their own self-employment taxes, and usually does not receive benefits. Independent contractors have more freedom to determine their work hours and methods and are often hired on a project basis with less job security.

1099 employee form

The 1099-NEC employee form is used to report payments made to independent contractors for the services they perform. It’s the responsibility of the 1099 employee to pay these taxes themselves, typically on a quarterly basis.

Organizations are required to send out 1099 forms to the payee and the IRS by a certain date each year, typically January 31st for the previous tax year. The official 1099-NEC form can be found on the IRS.gov website.

How to hire a 1099 employee

Hiring a worker as a 1099 independent contractor rather than a W2 employee involves a different process and adherence to certain legal regulations. Here’s a general process to follow:

1. Determine worker classification

Ensure the employee qualifies as an independent contractor under IRS guidelines. The IRS uses three categories to assess this: behavioral control, financial control, and the type of relationship.

2. Define the scope of the work

Create a detailed contract that outlines the services to provide, deadlines, payment terms and how the relationship can be terminated. It should also clarify that the worker is responsible for their own taxes and insurance.

3. Obtain the necessary documentation

The IRS requires independent contractors to complete the Form W-9. This document requests the worker’s name and taxpayer identification number, (TIN), as well as verifies their eligibility for employment in the United States.

4. Reporting requirements

If the independent contractor is paid $600 or more in a year, it’s necessary to file a Form 1099-NEC with the IRS and provide a copy to the contractor by January 31st of the following year.

5. Avoid misclassification risks

Misclassifying an employee as an independent contractor may lead to significant legal and financial penalties. It may be advisable to consult with a lawyer or a tax professional to make sure that the hiring process complies with current laws and that the contract covers all necessary aspects of the relationship.

HR tip

HR professionals must pay meticulous attention to correctly classify workers, distinguishing between W2 employees and 1099 independent contractors. Misclassification can lead to severe financial penalties, back taxes, and interest for failing to pay employment taxes; and can also result in liability for failing to provide employee benefits such as health insurance or workers’ compensation. It’s crucial for HR to stay informed on IRS guidelines and provide ongoing training to ensure that managers and staff involved in hiring understand the criteria for classification.

FAQs

The 1099-NEC form is a tax document used to report payments made to independent contractors and other non-employees for their services provided to the business. This document helps the IRS track the income that independent contractors should report on their tax returns. Businesses must send out Form 1099-NEC by January 31st following the tax year in which they made the payments.

The payment method for a 1099 employee varies depending on the agreed terms between the employer and the independent contractor, usually on an hour or project/job basis. Since these employees are not on payroll, the payment is usually made by check, direct deposit, or an electronic payment system.

There is no legal limit to how many hours a 1099 employee can work. The distinction lies in the level of control: unlike traditional employees, independent contractors have the freedom to set their own hours and decide how to complete the work. They are typically hired to perform a particular task or project, so they receive compensation for the outcomes delivered rather than the duration of time invested.

For informational purposes only: This HR Glossary entry is only intended for general information purposes and does not constitute professional advice. Always consult with a qualified professional for accurate, complete and current information.