Form 1096

What is Form 1096?

Form 1096 (Annual Summary and Transmittal of U.S. Information Returns) is a tax form that serves as a summary document that accompanies other IRS information return forms (1097, 1098, 1099, 3921, 3922, 5498, and W-2G forms). These information returns report various types of income, payments, and transactions that may be subject to federal income tax.

The Form 1096 is only sent with these forms if the above forms are filed by mail, so the form is not required if the forms mentioned above have been filed electronically.

What is Form 1096 used for?

Form 1096 serves as a summary of the information returns an organization submits to the Internal Revenue Service (IRS). If your business files more than one type of information return (e.g., 1099-NEC, 1099-MISC, 1099-K, etc.), a separate 1096 tax form is needed to accompany each information return filed during the year. Basically, the form acts as a cover page to help with the processing of the tax forms the IRS receives.

Since Form 1096 is only used when filed by mail, it is important to use an official version of the form. It can be purchased directly from the IRS or an approved third party, such as certain retailers or software programs. Using an unofficial printed version of the IRS Form 1096 can result in penalties.

Who has to file IRS Form 1096?

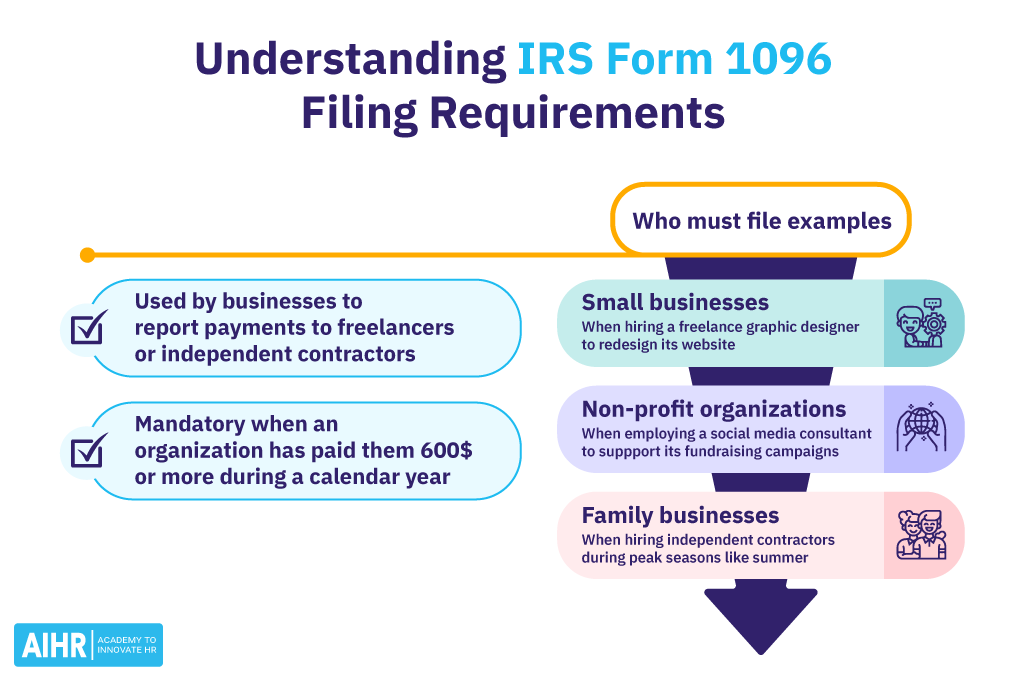

IRS Form 1096 is generally used by a business to report payments to freelancers or independent contractors. Filing Form 1096 is mandatory when a business has paid $600 or more to a freelancer or independent contractor during the calendar year. Employees and contractors do not need to submit Form 1096 – only the business.

Here are some different scenarios of who is required to file IRS Form 1096:

- A small business that hires a freelance graphic designer to redesign its website

- A non-profit organization that hires a social media consultant to support its fundraising campaign

- A small family business that hires independent contractors during the summer months.

When is Form 1096 due?

Companies must file Form 1096 with accompanying information return forms (1097, 1098, 1099, 3921, 3922, or W-2G) by February 28.

However, if you file the 1099-MISC form to report non-employee compensation (NEC), Form 1096 must be sent by January 31.

For Form 5498, the due date is May 31. You can review the unofficial paper version of the IRS Form 1096 to confirm due dates and specific mailing instructions.

How to fill out Form 1096

Here’s a step-by-step guide to filling out IRS Form 1096:

1. Fill in your business’s information: Provide the basic information at the top of Form 1096, including your business name, address, and employer identification number (EIN) in Box 1 or Social Security number (SSN) in Box 2.

2. Fill in Box 3: Enter the number of forms you are sending along with Form 1096. It is important to enter the correct total of forms (not pages) in Box 3 Form 1096.

3. Complete Box 4: Enter the total amount of federal income tax withheld on the forms that accompany this Form 1096.

4. Box 5 is optional: It is only mandatory when filing forms 1098-T, 1099-A, or 1099-G.

5. Box 6 checklist: Identify the information return form that accompanies Form 1096. You must mark an ‘X’ next to the name of the specific form.

6. Sign and date the form: The business owner or an authoritative representative needs to sign and date the form to verify the information provided is correct.

HR tip

Filing Form 1096 late can result in costly penalties from the IRS, which increase with the duration of the delay. So, timely filing of Form 1096 is essential. Submitting on time ensures compliance with tax regulations and demonstrates your organization’s commitment to financial responsibility and legal adherence. It’s key to stay updated on the filing deadlines and prepare the necessary documents well in advance to avoid last-minute rushes and potential errors.

FAQ

The IRS does require the use of a specific red ink version of Form 1096 when submitting paper forms. This is a requirement because the IRS uses specialized equipment to process them, and the red-ink version is compatible with this equipment. However, if you are filing electronically, the color of the form is not important.

Yes, it is possible to handwrite Form 1096. However, the handwriting must be clear. It is highly recommended to print your answers for legibility and to ensure greater accuracy.

No, Form 1096 is not required when filing information returns electronically. You must, though, submit the required information forms to the IRS using the appropriate forms and format.

For informational purposes only: This HR Glossary entry is only intended for general information purposes and does not constitute professional advice. Always consult with a qualified professional for accurate, complete and current information.