Performance Bonus

What is a performance bonus?

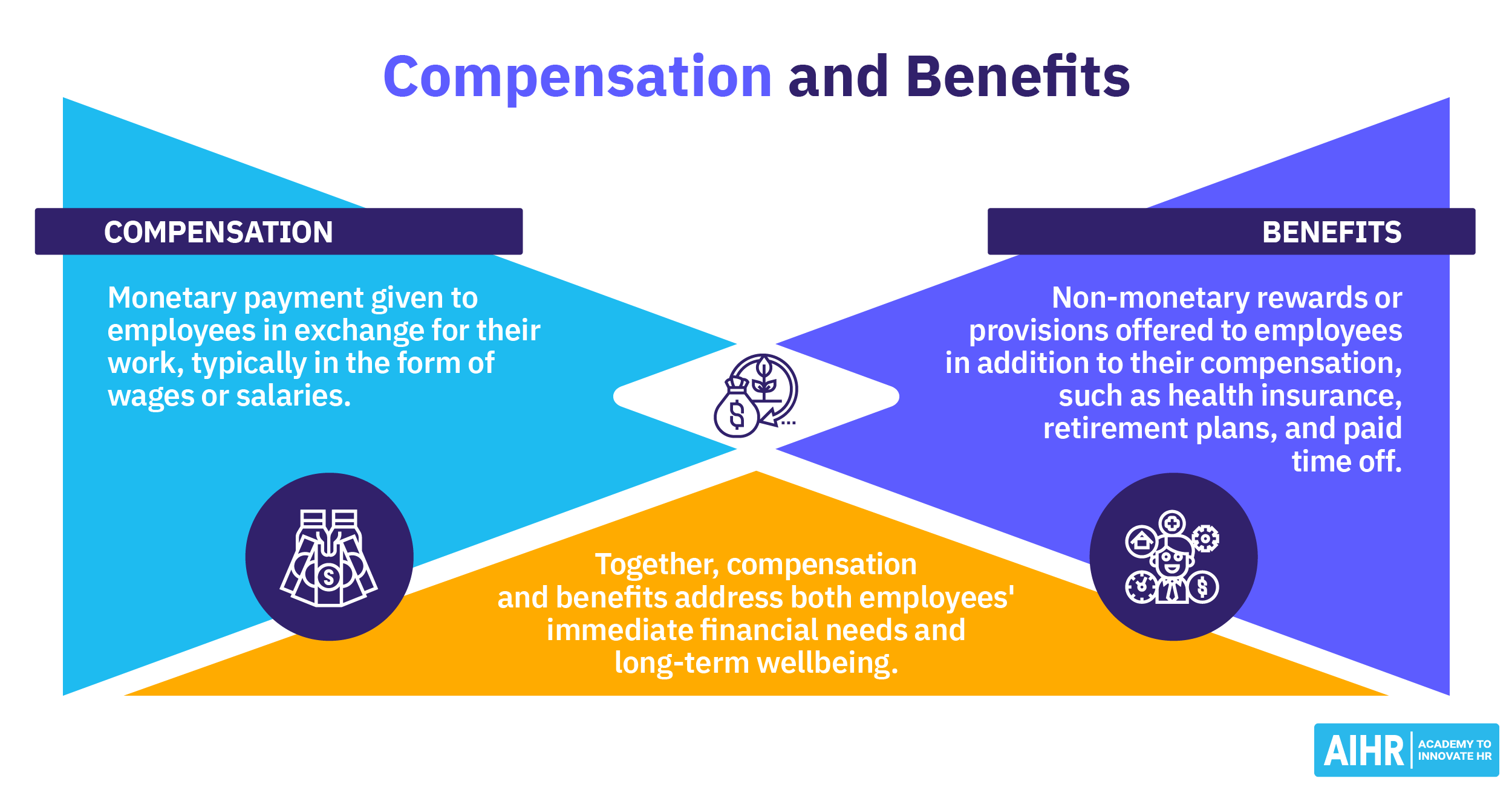

A performance bonus is a form of compensation granted to employees beyond their base salary for achieving specific goals or targets. Typically tied to individual achievements, these bonuses reflect exceptional performance over a specified period, whether monthly, quarterly, or annually. The nature and structure of these bonuses can vary widely depending on the organization, the role of the employee, and the industry.

What is an average performance bonus?

An average performance bonus can vary widely across industries, job roles, levels of seniority, and company sizes. A recent survey reported that, on average, exempt employees in the U.S. receive a bonus equal to 11% of their salary, while nonexempt salaried employees get 6.8%, and hourly workers receive 5.6%.

Advantages and disadvantages of performance bonuses

Performance bonuses come with their own set of advantages and disadvantages:

Boosts employee motivation and productivity by rewarding high-performance.

May lead to unequal rewards, causing dissatisfaction among employees.

Aligns employee goals with overall company objectives.

Can lead to a focus on short-term results at the expense of long-term goals.

Attracts top talent and helps retain high performers.

Can increase stress and pressure, potentially leading to burnout.

Offers financial flexibility to the company as bonuses are often tied to profits and performance.

Employees may become dependent on bonuses, affecting motivation when these are not available.

Balancing these advantages and disadvantages involves structuring bonuses carefully, ensuring transparency, fairness, and clear communication about the criteria and expectations. Additionally, combining bonuses with other recognition programs and fostering a supportive work environment can mitigate potential drawbacks while maximizing the benefits of performance bonuses.

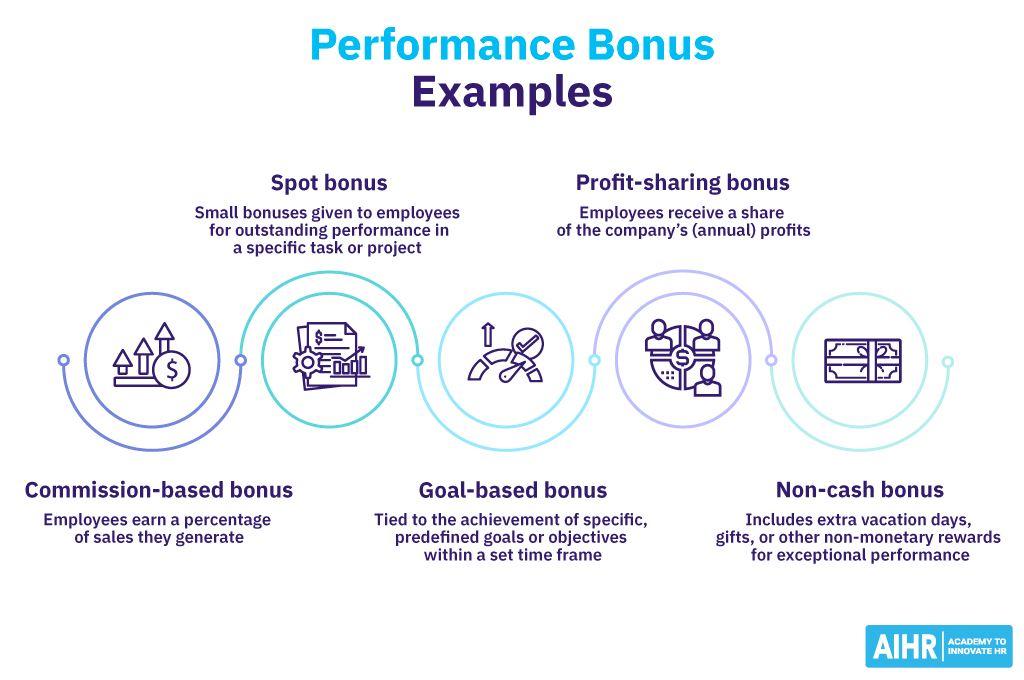

Performance bonus examples

Some common examples of performance bonuses include:

- Commission-based bonus: Common in sales roles, employees earn a percentage of sales they generate. For instance, a car salesperson might earn a commission for each car sold.

- Spot bonus: Small, immediate bonuses given to employees for outstanding performance in a specific task or project. For example, an employee might receive a spot bonus for going above and beyond to help a client.

- Goal-based bonus: These bonuses are tied to achieving specific, predefined goals or objectives within a certain time frame. For example, an employee might receive a goal-based bonus for meeting performance targets or completing a critical project by a specific deadline.

- Profit-sharing bonus: Employees receive a share of the company’s profits, often distributed annually. For instance, a company might allocate a percentage of its annual earnings among all employees.

- Non-cash bonus: These could include extra vacation days, gifts, or other non-monetary rewards for exceptional performance.

How to calculate a performance bonus

A company might calculate performance bonuses by multiplying an employee’s base salary by a predetermined percentage, with adjustments based on individual and team achievements.

For instance, if the bonus percentage is 10%, an employee with a $50,000 salary might receive a $5,000 bonus for meeting or exceeding performance targets.

Bonus=Annual Salary×Bonus Percentage

Bonus= $50,000×10= $5,000

Performance bonus policy: What to include

Creating a comprehensive and effective performance bonus policy involves including several key elements to ensure clarity, fairness, and alignment with your company’s goals. Here’s what to include in a performance bonus policy:

- Eligibility criteria: Clearly define who is eligible for the performance bonus. Include factors such as employment status, tenure, or specific roles within the organization.

- Performance metrics: Specify the metrics or goals employees must meet to qualify for the bonus. These can be individual or team-based and should be measurable and aligned with the company’s objectives.

- Calculation method: Describe how the bonus will be calculated. It can be a percentage of the employee’s salary, a flat rate, etc.

- Payment schedule: Outline when bonuses will be paid out. This should be consistent and predictable.

- Performance improvement plans: For those not meeting the criteria, outline the availability of performance improvement plans or support.

- Compliance with labor laws: Address any legal or tax considerations relevant to bonus payments.

- Review and update procedure: Specify the frequency of policy reviews and updates to reflect the evolving needs of the business and its workforce.

HR tip

Ensure that the eligibility criteria, performance metrics, and bonus calculation methods are transparently and effectively communicated to employees. This fosters trust, motivation, and a better understanding of how individual efforts contribute to the organization’s overall success.

FAQ

Performance bonuses vary widely depending on the industry, company, and individual performance metrics. Generally, a typical performance bonus might range from 5% to 20% of an employee’s base salary, but it can also be a fixed amount.

“Bonus on performance” means a financial reward given to an employee based on their work performance. This bonus is typically in addition to their regular salary and is awarded for achieving specific performance targets or exceeding expectations in their role.