Pay Compression

What is pay compression?

Pay compression, also known as salary compression or wage compression, occurs when there is only a small difference in pay between employees regardless of their skills, experience, seniority, or job responsibilities. This situation can lead to several issues within the workplace, including dissatisfaction and demotivation among longer-tenured or more experienced employees.

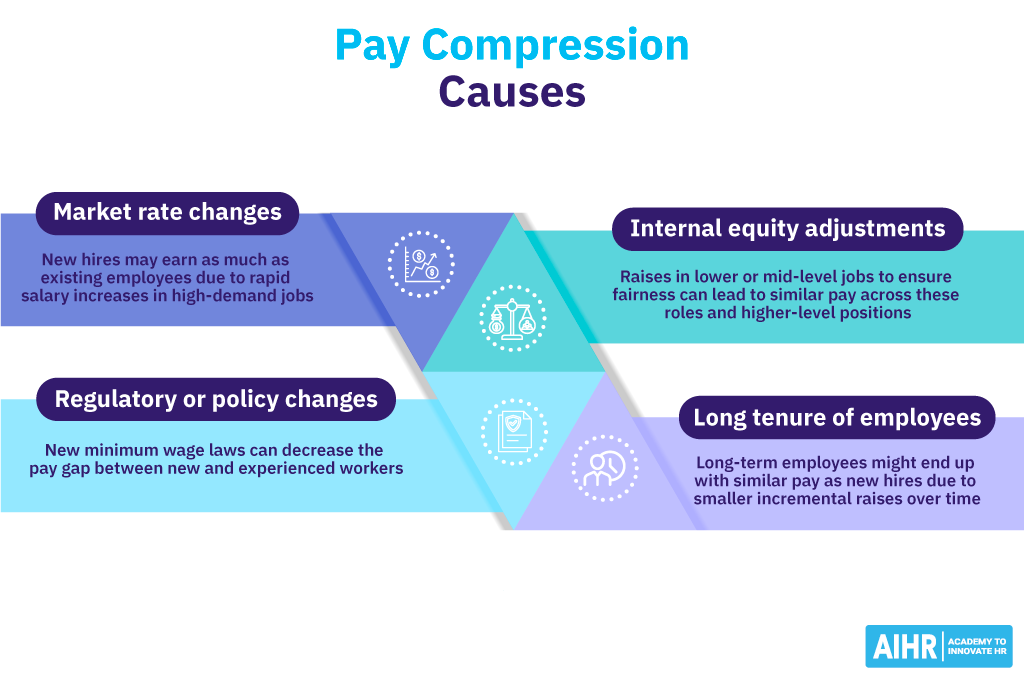

What causes pay compression?

Pay compression can arise due to several factors, including:

- Market rate changes: When the market rate for a certain job increases rapidly due to high demand and a shortage of skilled workers, new hires may demand salaries close to or even exceeding those of existing employees in similar roles.

- Internal equity adjustments: In an effort to maintain fairness and internal equity, organizations sometimes raise the salaries of lower or mid-level positions, which can result in those roles being paid similarly to higher-level positions.

- Regulatory or policy changes: Changes in minimum wage laws or other employment regulations can push entry-level wages closer to those of more experienced employees, especially in industries with traditionally lower pay scales.

- Long tenure of employees: In organizations with low turnover, long-tenured employees may experience smaller incremental raises over time, which can result in their pay being similar to that of newer employees who are hired at current market rates.

Pay compression vs. pay inversion

Minimal difference in pay between employees regardless of their experience or job level.

Newer or lower position employees earn as much as or more than those with more experience or in higher positions.

Caused by inadequate adjustment of pay scales over time and market rate adjustments not keeping pace with industry standards.

Caused by market rate changes leading to higher salaries for new hires, talent shortages that demand higher starting salaries, and inadequate salary reviews for current employees.

Reduces motivation and incentive for professional development or taking on additional responsibilities.

Leads to dissatisfaction among long-term employees and potential turnover of experienced staff.

Solutions include regular pay analysis, adjusting pay scales, and implementing fair pay policies.

Solutions involve regular review and adjustment of pay structures and transparent communication about pay practices.

Pay compression examples

Here are two fictional examples to better understand the concept of pay compression.

1. Tech startup

In a rapidly growing tech startup, entry-level software engineers were initially hired at a salary of $70,000 per year. Due to the competitive market, two years later, new engineers with similar qualifications are being offered $85,000 to start. However, the salaries of the initial employees have only been adjusted to $75,000 in the same period.

2. Retail management

A retail chain has a policy of annually increasing its store managers’ salaries by 2%. A manager who started five years ago was initially making $50,000 and now earns $55,100. As a consequence of market pressures and the need to attract talent, a new manager at a similar store is hired at a starting salary of $55,000.

HR tip

Regularly review and adjust salaries in line with market trends and set clear, consistent criteria for raises and promotions, ensuring equitable and competitive pay across the organization.

How HR can address pay compression

Addressing pay compression effectively requires a strategic approach. Here are several steps HR can take:

- Step 1. Conduct regular salary audits: Regularly review and analyze the entire compensation structure to identify instances of pay compression.

- Step 2. Establish clear pay structures: Develop and maintain clear, transparent pay structures based on roles, experience, skills, and performance.

- Step 3. Analyze market rate: Adjust salary scales to reflect changes in the labor market. This can help keep salaries competitive and address instances where external hires might be recruited at higher pay rates than existing employees.

- Step 4. Implement performance-based pay increases: Ensure that pay raises are linked to performance, skills, and contributions rather than solely on tenure. This can help differentiate pay based on merit.

- Step 5. Address anomalies proactively: When instances of pay compression are identified, it might be necessary to give raises to certain employees to realign salaries with their roles and experience.

- Step 6. Regularly review the policy: Regularly review and update compensation policies to ensure they remain effective and relevant in addressing pay compression and other compensation-related issues.

FAQ

While pay compression itself is not illegal, it might lead to legal complications if it results in discriminatory practices that violate laws like the Equal Pay Act or the Civil Rights Act. While not unlawful, it can negatively impact employee morale and retention.

To avoid pay compression, employers should regularly review and adjust salary structures, establish clear pay policies, and ensure pay increases for existing employees keep pace with those for new hires.

Wage compression under the Equal Pay Act occurs when pay differences between new and experienced employees narrow significantly, potentially leading to unequal pay for similar work and raising discrimination concerns.