Home Office Stipend

What is a home office stipend?

A home office stipend is an allowance or reimbursement grant by an employer to cover the expenses associated with setting up and maintaining a home office.

Also known as a work-from-home or remote work stipend, this money is intended to help employees who work remotely (either partially or fully remote) make their workspaces more comfortable and improve overall productivity.

How much should a home office stipend be?

The amount of a remote work stipend can vary widely from one company to the next. While some offer a one-time stipend, usually for new hires, others may allocate an annual amount for updating home equipment when necessary.

One-time stipends can range from as little as $100 to $1,000 or more, depending on the employer’s objectives and the expenses they intend to cover with it. Annual work-from-home stipends are issued annually and generally range between $200 and $500.

To determine the amount of a remote work stipend, employers should consider what employees are expected to buy with that money. Often, a home office stipend is intended to cover the basic cost of furniture for a home office, including a desk and office chair. However, a work-from-home stipend can also be used to cover essential hardware the employee uses, internet costs, phone costs, and more.

Is a home office stipend taxable?

A home office stipend can be taxable, depending on the circumstances and the tax laws of the country in question.

In the United States, for example, the tax treatment of such stipends can vary based on whether the employer has an accountable plan. Under this plan, if the employee provides proof of the expenses and they are deemed necessary for business purposes, the stipend may not be taxable. Without an accountable plan, the stipend is usually added to the employee’s taxable income.

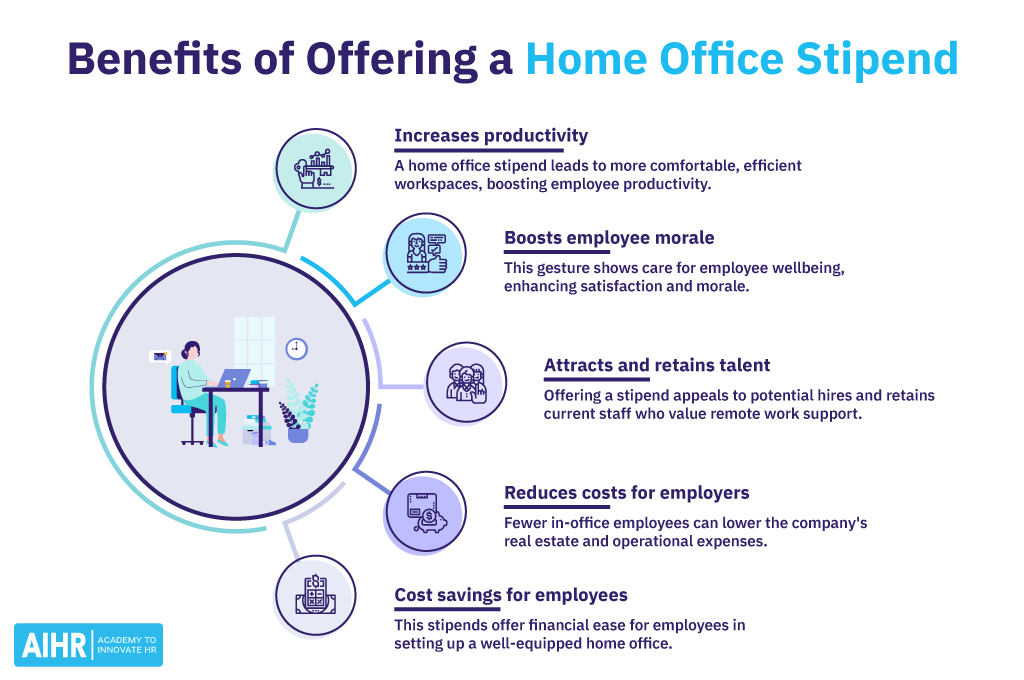

Benefits of offering a home office stipend

Offering a home office stipend to your employees can come with several benefits:

- Increases productivity: A home office stipend allows employees to create a comfortable and efficient workspace. Comfortable and ergonomically correct furniture, proper lighting, and necessary technological equipment can significantly boost productivity.

- Boosts employee satisfaction and morale: Providing a stipend shows employees that the company cares about their comfort and wellbeing. This can increase job satisfaction and morale, often resulting in better work performance.

- Attracts and retains talent: Home office stipends can be an attractive perk for potential hires. It also helps retain existing employees who might value the flexibility and support for remote work.

- Reduces costs for employers: For companies, having more employees working from home can mean a reduced need for large office spaces, leading to potential savings on real estate and associated costs.

- Cost savings for employees: Offering a home office stipend can offset employees’ costs when setting up a home office. This makes it financially more accessible for employees to maintain a well-equipped home-office environment.

Examples of home office stipends

Many companies choose to offer home office stipends to their employees. These stipends can vary considerably, so evaluating what your company can offer is essential. Here are some examples:

- Google issued a $1,000 one-time home office stipend during the pandemic so employees could more easily transition to a work-from-home environment.

- Buffer offers a $500 home office stipend to set up your home office.

- Appcues provides a $1,000 home office stipend and an additional $500 annually for extra work-related technology.

- Basecamp offers up to $3,000 on a new desk, new desk chair, computer accessories, or other office furniture.

- Applecart has a $300 one-time home office stipend granted to new hires.

Home office stipend policy: What to include

When developing a home office stipend policy, HR should ensure that the policy is effective and fair and supports employees in creating a productive work environment at home. Here are some key elements to consider:

- The amount and frequency of the stipend: Determine how much the stipend will be and how often it will be paid. The amount should reflect the cost of setting up and maintaining a home office, and the frequency could be a one-time, annual, or monthly payment.

- Who is eligible for the stipend: Specify whether the stipend will be different for employees at different levels of the organization or in specific positions. This could be based on factors such as job role, level of remote work, or employment status (full-time vs. part-time).

- What the stipend can be used for: This may include ergonomic furniture, computer hardware and software, internet service, phone expenses, and office supplies. Providing a detailed list helps employees make appropriate spending decisions.

- The process for expense reporting and reimbursement: Outline the process for submitting expenses, including any necessary documentation and timelines. This ensures transparency and efficiency in managing reimbursements.

- Tax implications: Address any tax implications for the stipend, both for the employer and the employee. This might involve consulting with tax experts to understand how the stipend affects taxable income.

- Feedback mechanism for employees: Establish a feedback mechanism where employees can share their experiences and suggestions regarding the stipend policy. This helps in making continuous improvements based on actual employee needs and experiences.