Pay Group

What is a pay group?

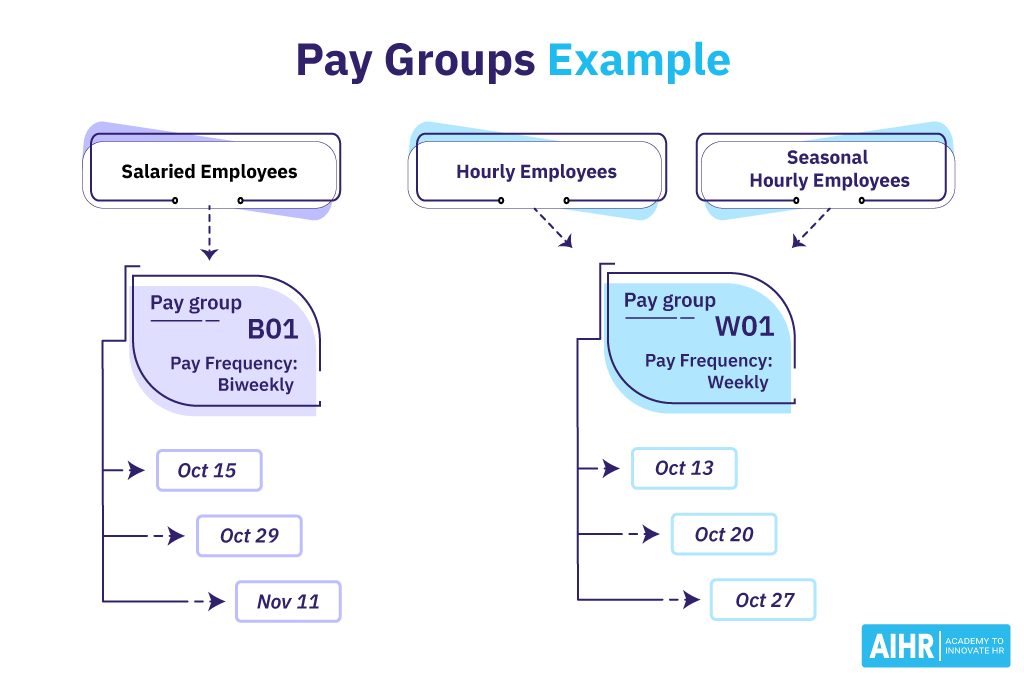

A pay group is a set of employees grouped according to shared characteristics and paid on the same schedule. Grouping employees in this manner ensures easier processing of the payroll. A pay group enables a company to sort employees based on pay frequency.

An employee may only belong to one pay group, and each group is assigned a group code in an organization’s payroll system. Companies typically have multiple pay groups based on, for example, pay frequency, employee type, and shared location.

What are examples of pay groups?

- Wage vs. salary: Some employees are paid a wage according to an hourly rate, while others are paid a monthly salary. These groups would appear on two separate payrolls.

- Location: A company might have employees in different cities or even countries. A pay group may be named after each location and follow different payroll schedules.

- Executive payment: CEOs and high-level executives may not be visible to everyone due to specific regulations and may form part of a separate pay group.

- Pay frequency: Employees paid weekly, biweekly, and monthly would belong to different pay groups.

- Union: Union and non-union employees.

- Tax: Employees that are tax-exempt and those that are not.

Here is an example of what a pay group would look like in the backend of a payroll system:

How is a pay group assigned?

A pay group is assigned based on key identifiers (location, frequency, executive vs. non-executive, etc.). A company might use a checklist to verify an employee has correctly been allocated to the pay group, such as:

- Paid at the same frequency

- Uses the same bank

- Paid in the same location

- Have the same work schedule

- Affected by various labor laws in the same way

When the employer makes changes to the pay group of a certain employee, this is typically applied to the next pay run.