Co-Employment

What is co-employment?

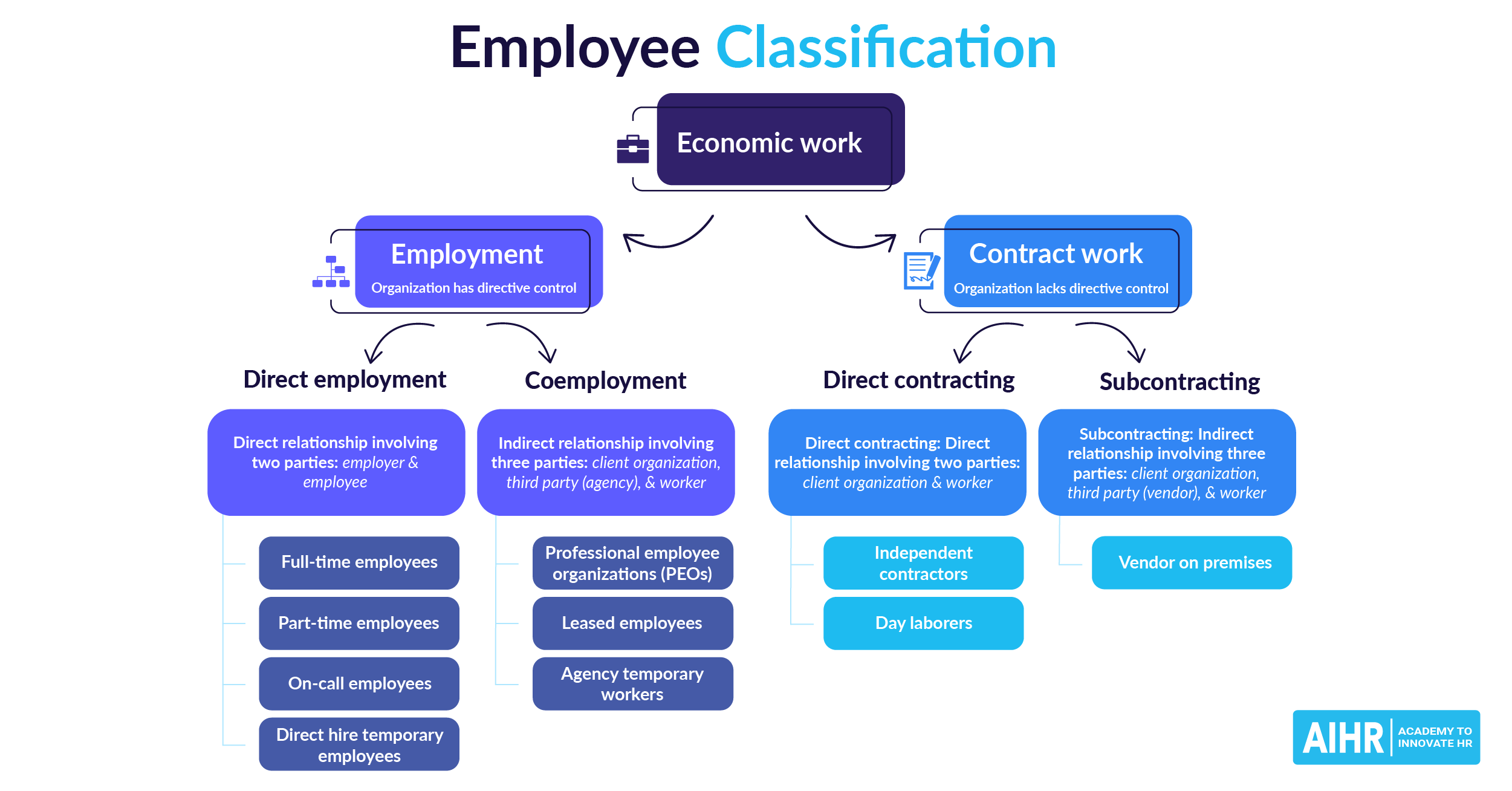

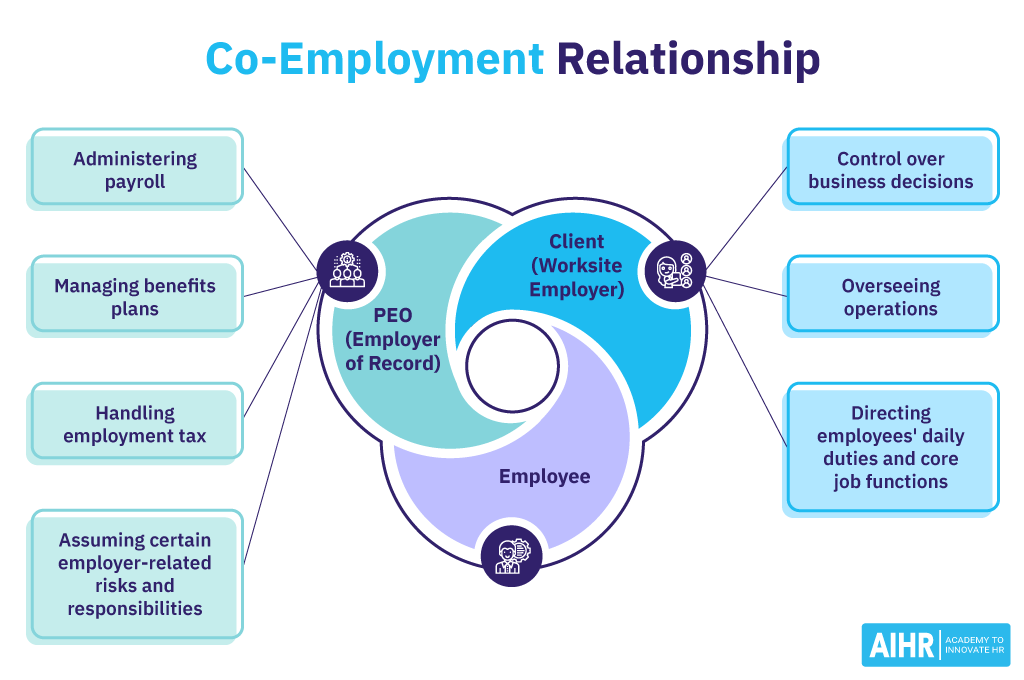

Co-employment is a relationship where two or more employers share the responsibility and liability for an employee.

In this arrangement, one employer is typically the primary one, while the other is secondary, often a professional employer organization (PEO). The primary employer maintains control over day-to-day tasks and directs the employee’s work, while the PEO takes care of administrative functions like payroll, benefits administration, and HR compliance.

How does co-employment work?

In a co-employment relationship, the PEO becomes the official employer of record for the employees, but they continue to work at the client company. The PEO takes over various administrative and HR-related tasks, such as payroll processing, benefits administration, tax filing, and compliance with employment laws. This allows the client company to focus more on its core business activities while the PEO manages the complexities of employment responsibilities.

Co-employment examples

Here are some common examples of co-employment:

- Small businesses and PEOs: Small businesses often lack the resources or expertise to handle complex HR functions like payroll, employee benefits, compliance with labor laws, and workers’ compensation. By entering into a co-employment relationship with a PEO, these businesses can outsource these responsibilities.

- Startups and HR outsourcing: Startups, especially those in growth phases, may not have a fully developed HR department but need to rapidly scale their workforce. Partnering with a PEO allows them to quickly onboard new employees, provide competitive benefits, and ensure compliance with employment laws without building an extensive in-house HR infrastructure.

- Seasonal businesses: Businesses with significant fluctuations in workforce needs due to seasonal demand (like retail stores during holidays) often rely on co-employment arrangements. They partner with staffing agencies or PEOs to scale their workforce up and down efficiently as needed.

Co-employment vs. joint employment

Co-employment and joint employment are two different concepts often used in employment relationships. Here’s a breakdown of the differences between the two:

| Co-employment | Joint employment | |

| Definition | A relationship where two companies both act as employers of the same employee, typically in a PEO arrangement. | A legal situation where two or more businesses jointly determine key aspects of an employee’s work. |

| Purpose | Often used to outsource HR, payroll, and benefits administration. | Arises when multiple businesses share control over the same employees, usually due to operational needs. |

| Legal responsibility | Both entities share legal and employer responsibilities, but often with clear delineation of roles. | Both employers are responsible for compliance with employment laws, often without clear role delineation. |

| Common scenarios | Common in relationships with Professional Employer Organizations (PEOs). | Often seen in franchisor-franchisee relationships, contractor-subcontractor relationships, etc. |

| Risk sharing | Risks, especially related to HR compliance, are shared between the PEO and the client company. | Risks are shared between the joint employers, often leading to complex legal implications. |

What are the benefits of co-employment?

Some of the most significant benefits of co-employment are:

- HR administration and support: Co-employment allows businesses to outsource complex and time-consuming HR tasks. This includes recruitment, payroll processing, employee benefits administration, and compliance with labor laws.

- Expertise in diverse HR areas: PEOs bring expertise in a wide range of HR areas, which can be especially beneficial for businesses that do not have in-depth HR knowledge.

- Lower costs: While there are fees associated with PEO services, these can be offset by the reduced need for in-house HR staff and the economies of scale achieved in areas like health insurance and workers’ compensation insurance.

- Compliance and legal expertise: Keeping up with labor laws, tax codes, and regulatory changes can be challenging. PEOs are well-versed in these areas and can make sure that your business remains compliant, reducing the risk of legal issues.

What are the risks of co-employment?

Some of the most significant co-employment risks to consider include:

- Confusion over employer responsibilities: Co-employment situations can lead to confusion about which entity is responsible for certain aspects of employment, such as payroll, benefits, and worker’s compensation.

- Employee misclassification: If contractors or temporary workers are treated similarly to regular employees, they may be deemed co-employed. This misclassification can lead to legal repercussions, including fines and requirements to pay back wages.

- Benefits discrimination: If co-employed workers receive different benefits than regular employees, it could lead to discrimination claims. This can be particularly challenging when co-employed workers perform tasks similar to regular employees but receive lesser benefits.

- Legal and regulatory compliance: Both parties in a co-employment relationship must ensure compliance with a wide range of employment laws and regulations. This includes wage and hour laws, anti-discrimination laws, and workplace safety regulations. Missteps can lead to legal liabilities for one or both parties.

In 2000, Microsoft was involved in a co-employment lawsuit for denying benefits to long-term temporary workers, treating them similarly to regular employees without the same benefits. The court ruled in favor of the workers, recognizing them as de facto employees. This led Microsoft to pay significant settlements and revisit its employment strategies, impacting how companies handle co-employment and classify temporary workers.

How can HR avoid co-employment risks?

Some of the most important things to keep in mind when it comes to avoiding co-employment violations when working with PEOs and independent contractors include:

- Correctly classify independent contractors: It’s essential to classify workers as either employees or independent contractors accurately. HR should carefully evaluate the nature of the working relationship, considering factors such as degree of control, level of independence, and scope of work.

- Avoid treating contractors like employees: Ensure that independent contractors are not treated similarly to employees. This includes avoiding actions such as providing employee benefits, dictating work schedules, or exerting excessive control over their work.

- Maintain a clear separation of responsibilities: Establish contractual agreements with third-party providers, such as staffing firms or professional employer organizations (PEOs), to define the division of responsibilities and liabilities. Clear delineation of roles can help avoid confusion and potential co-employment issues.

- Foster open communication: It’s crucial to maintain open lines of communication between employees and independent contractors. Encouraging collaboration while respecting the distinct nature of their working relationships can help minimize co-employment risks.

- Partner with experienced engagement firms: Working with reputable staffing firms or engagement firms can provide additional expertise in managing co-employment risks. These firms can offer guidance on compliance, proper classification, and best practices when engaging contingent workers.

- Understand employment laws: Be aware of local, state, and federal employment laws. This knowledge helps ensure that your organization does not inadvertently assume employer responsibilities, especially in areas like wage and hour laws, benefits, and taxes.