Clawback

What is a clawback?

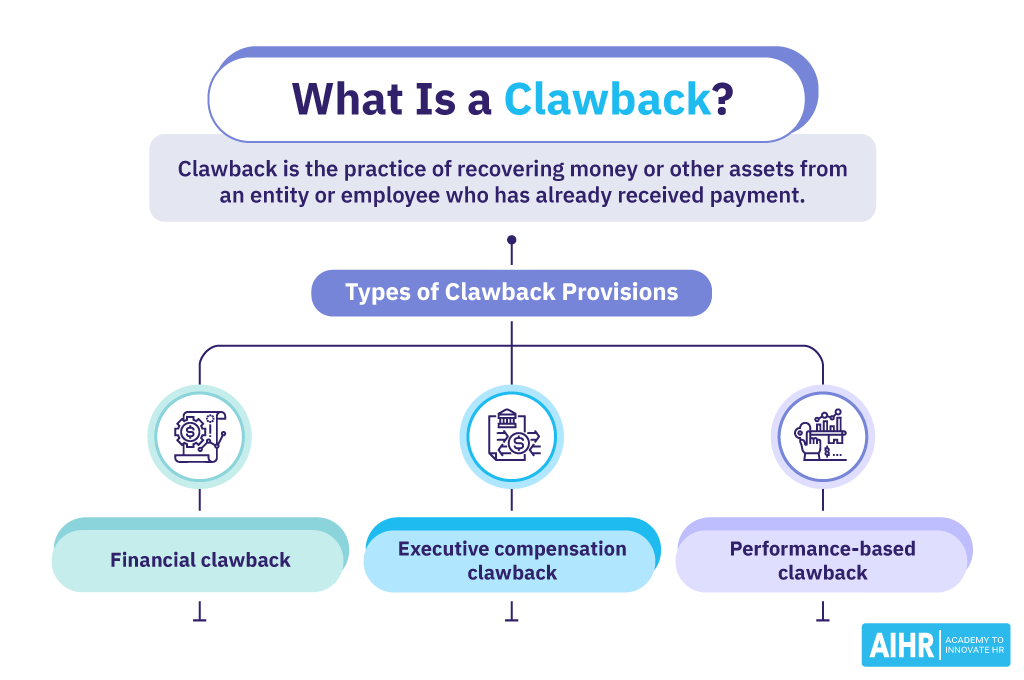

In HR and legal terms, clawback is the practice of recovering money or other assets from an entity or employee who has already received payment. It’s often used to recoup losses from a particular situation, such as fraud or financial mismanagement.

Clawbacks can also be used to recover compensation in cases of breach of contract, violation of non-compete agreements, or other instances where an employee has received payment or benefits to which they were not entitled.

For example, an employee receives incentive-based pay like a bonus, but it’s later discovered that they did not meet the performance standards. In that case, the employer may be entitled to ask for the bonus money back – sometimes with a penalty.

Key elements of a clawback

The clawback provision should contain the following elements:

- Purpose: As no two organizations are the same, each clawback provision should be tailored to the particular situation. It must identify the conditions that will trigger a clawback and state how much money, equity, or benefits the employer is entitled to reclaim.

- Triggering events: These are the conditions that must be met for a clawback to take effect. This could include financial mismanagement, fraud, and other unauthorized activities that result in the employer suffering a loss.

- Impact: The impact of clawback is two-fold. On the one hand, it can negatively impact an employee’s financial compensation if they pay back money or assets previously rewarded. On the other hand, it can deter employees from engaging in fraud or other unethical practices, as they will know there may be consequences for their actions.

- Timeframe: Clawbacks can have expiration dates. This determines when the employer can no longer seek compensation from an employee for any losses incurred. However, it is not a universal requirement. The timeframe for a clawback can vary depending on the circumstances and the jurisdiction’s laws or regulations.

While these elements are commonly found in clawback provisions, the specific details and requirements can vary depending on the organization and the purpose of the clawback. Not all clawback provisions will have the same structure or include all of these elements.

Reasons for implementing clawback provisions

Different organizations have different motivations for adopting clawback policies. But here are some critical reasons that cut all across:

- Mitigating financial losses: A clawback policy is an excellent shield against financial risks. Think of it as insurance coverage; it protects the organization from any losses that may arise due to employee misconduct. It also protects you from risks like underperformance, financial mismanagement, and other actions that could cause harm to the company’s bottom line.

- Ensuring accountability and ethical conduct: Clawback provisions also help maintain the organization’s integrity by ensuring that employees comply with organizational rules and regulations. It reminds staff members that they are accountable for their actions and should not abuse their authority or privileges.

Examples of clawback provisions

Common clawback arrangements include financial, executive compensation, and performance-based clawbacks:

1. Financial clawback

A financial clawback is often triggered when, for example, an employee or executive has engaged in financial mismanagement. Such situations include manipulating the books to increase profits and other forms of financial misconduct like misappropriation of funds, embezzlement, or insider trading. In these situations, the employer may reclaim any bonuses, commissions, or other benefits given out during the period in question.

Here’s a practical example: Imagine an employee receiving a year-end bonus for meeting their sales quota. However, the employer later discovers that the employee manipulated the company’s financial records to meet their goal. In this scenario, the employer would likely trigger a financial clawback and reclaim the bonus payment given to the employee.

2. Executive compensation clawback

An executive compensation clawback occurs when an executive is required to return a portion or all of their salary, bonus, or other compensation received for the year. This type of clawback is usually triggered in situations where an executive is found to have engaged in misconduct or unethical behavior, such as accounting fraud, violation of company policies, or regulatory non-compliance.

For example, a senior executive receives a large bonus after closing a colossal deal. However, at the end of the year, it’s discovered that the deal was premature or fraudulent, and the entire agreement is canceled. In this situation, the executive may be required to return some or all of their bonus due to a triggered executive compensation clawback.

3. Performance-based clawback

Organizations use a performance-based clawback policy to ensure employees remain focused on meeting or exceeding their goals. This type of clawback is triggered when an employee fails to meet set targets, such as sales quotas, customer satisfaction ratings or misrepresentation of performance, falsifying records, or violating compliance standards

Here’s a practical example: Suppose an employee has received a commission for closing five deals in the past quarter. However, at the end of the quarter, it was discovered that two of those deals had been canceled. As a result, the company may require the employee to return a percentage of their commission as part of a performance-based clawback.

Challenges of a clawback

Despite its advantages, implementing a clawback policy can cause several challenges for an organization. Here’s a closer look:

- Clawback enforceability and legal limitations: Enforcing a clawback provision can be difficult, as it may require legal action to recover employee compensation. Additionally, clawbacks are limited by the employee’s contract and any applicable laws or regulations.

- Impact on employee motivation and incentives: Although clawback provisions can create a culture of accountability within an organization, they can also damage employee morale. Organizations risk reducing motivation and the desire to go above and beyond by requiring employees to return compensation.

HR best practices for implementing clawback policies

The most successful organizations have implemented best practices to ensure their clawback policies are effective and legally compliant. Here’s a closer look at some best practices:

- Developing clear and transparent clawback policies: HR should clearly define the terms of their clawback policy, including the circumstances that trigger it and the amount of compensation that can be reclaimed.

- Balancing fairness and effectiveness: Striking the right balance between fairness and effectiveness is essential when developing clawback policies. Organizations should ensure their policy is equitable for all employees while also providing an effective deterrent from unethical behavior. To achieve this, organizations should involve HR to ensure fairness and consistency in applying the policy.

- Regular review and adaptation of clawback provisions: HR should regularly review and adjust their policies to reflect changing regulations, market conditions, and employee expectations. By doing so, organizations can continuously improve their policy’s effectiveness while complying with applicable laws or regulations.