Agent of Record

What is an agent of record (AOR)?

An agent of record (AOR) is a designated representative (an individual or company) with the authority to manage employee benefits, insurance policies, payroll, or other administrative HR tasks for an organization.

The agent of record is the primary contact between the organization and external providers, overseeing the administrative processes and ensuring compliance with regulations. On behalf of HR, the AOR may advocate for its best interests when dealing with providers, providing cost savings and increased efficiency.

Why would HR want to appoint an agent of record?

An agent of record can provide HR departments invaluable support in the following areas:

- Specialized expertise: AORs can offer technical knowledge in areas where an HR department may need more expertise, such as payroll tax compliance, employment law, and global employee benefits, among others.

- Administrative efficiency: By handling administrative tasks such as employment contracts, onboarding, payroll, or benefits administration, AORs reduce the burden on HR teams, freeing them up to focus on strategic initiatives.

- Global compliance: Operating in multiple countries or regions requires complex legal and regulatory compliance. AORs can manage local employment laws and regulations, reducing the risks for HR departments.

- Contractor relations: Since AORs act as intermediaries, they usually have the ability to negotiate favorable terms with HR providers.

What is an agent of record letter?

An agent of record letter is a formal document that designates a new agent to serve as the legal representative for an organization. It outlines the nature of the relationship for a certain HR function or service. For example, it specifies the role and responsibilities of the agent of record, such as handling payroll, employee benefits, or health insurance contracts.

Agent of record vs. broker of record: The key differences

Although the two terms are often used interchangeably, there are some differences.

Acts as an authoritative representative for a specific HR function or service

Acts as an intermediary between individuals or companies and insurance companies

Has the authority to make decisions and work on behalf of an HR department

Mostly advise clients and do not act on their behalf

They engage in responsibilities such as processing payroll, managing health insurance plans, and administering benefits

Could serve as a health insurance broker, supporting an organization in choosing insurance plans, negotiating terms, or managing claims.

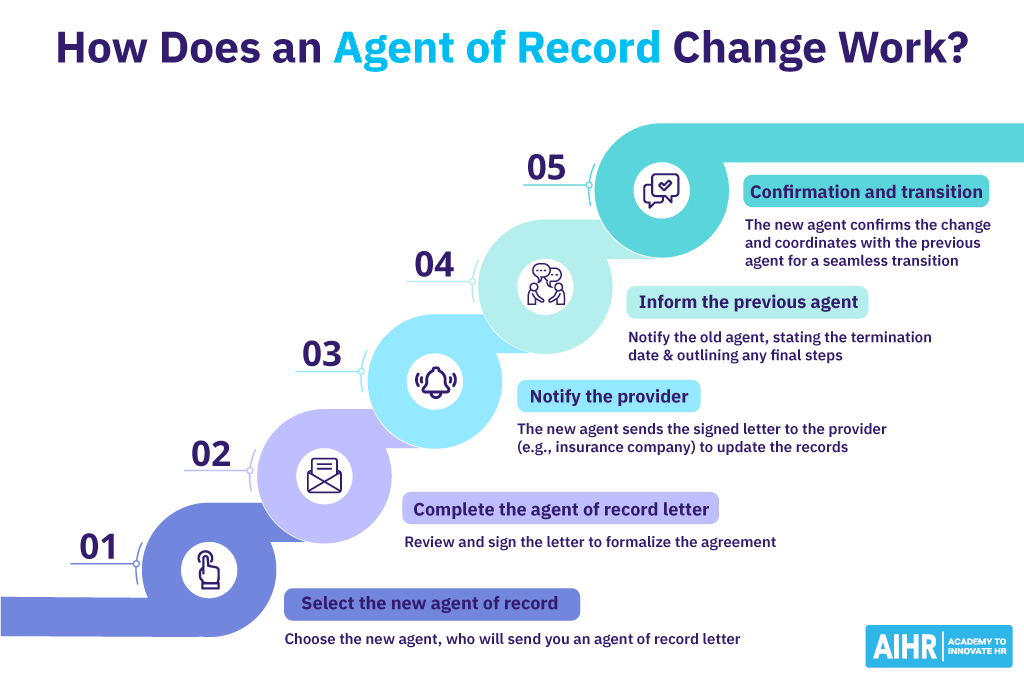

How does an agent of record change work?

If you are not completely satisfied with an agent of record, it’s possible to switch to a new agent. Here are some key steps to make the change:

- Select the new agent of record: Choose the new agent, who will then send you an agent of record letter.

- Complete the agent of record letter: Review and sign the letter to formalize the agreement.

- Provider notification: The new agent sends the signed letter to the provider, such as an insurance company, to register the change.

- Inform the previous agent: Formally notify the old agent, stating the termination date and outlining any final steps.

- Confirmation and transition: The new agent confirms the change details and works with the previous agent to ensure a smooth handover.

What should HR know before signing an AOR?

Before signing an agent of record agreement, HR professionals should spend some time doing the following:

- Understand the reasons for the change: Specify why you are making the change. Do you want better service, specific expertise, more comprehensive coverage, and lower costs? Make sure the new agent can meet your needs.

- Research qualifications and experience: Conduct thorough research into the new agent’s background and track record. HR professionals should focus on the agent’s expertise in handling similar providers or track records in your industry.

- Consider how the change will affect current providers: Determine the exact implications for changing agents. For insurance policies, HR will need to know how coverage, premiums, or existing claims might be affected.

- Determine any cost implications: Will there be any service fees for terminating your previous AOR agreement? Are there costs associated with entering a new AOR relationship? Are there other financial considerations that might impact your HR budget? These are all questions to consider in advance.

Rescinding agent of record letter

If your current agent is not meeting your HR expectations, you may need to terminate your agent of record letter, particularly for the following reasons:

- Unsatisfactory service quality

- Lack of communication

- Change in HR priorities and strategies

- Organizational restructuring

- Cost concerns

- Compliance violations.

Tips for terminating an agent of record agreement

Before you terminate the agreement, carefully consider the following:

- Understand the legal and contractual obligations: Review the agreement to determine termination procedures, notice periods, and any associated penalties.

- Seek legal counsel: To ensure you are following contractual terms, consult your legal team to avoid any non-compliance claims.

- Plan for transition: A detailed transition plan will help avoid major disruptions to HR processes. Determine interim procedures such as finding a new agent.

- Communicate with key stakeholders: Be transparent with all key stakeholders – employees, service providers, and the AOR – about the upcoming termination.

- Finalize agent handover procedures: Ensure the AOR finalizes outstanding duties before the termination date.

FAQ

An agent of record agreement is a formal document that designates an agent of record, outlining their role and responsibilities. The agreement authorizes the agent to handle a specific HR function or service, such as employee benefit administration.

When you realize you have signed a bad AOR agreement, it’s important to first discuss your concerns with the agent. Determine if there is a possibility of reaching a resolution or renegotiating unfavorable terms. If it’s not possible to get an agreeable solution, you can take the following steps:

• Carefully review the terms of termination, including any potential penalties

• Get legal advice to identify any unfair terms or agent violations

• Maintain records and communications that can be used in the event of any legal disputes

• Terminate your existing AOR agreement and search for another agent.